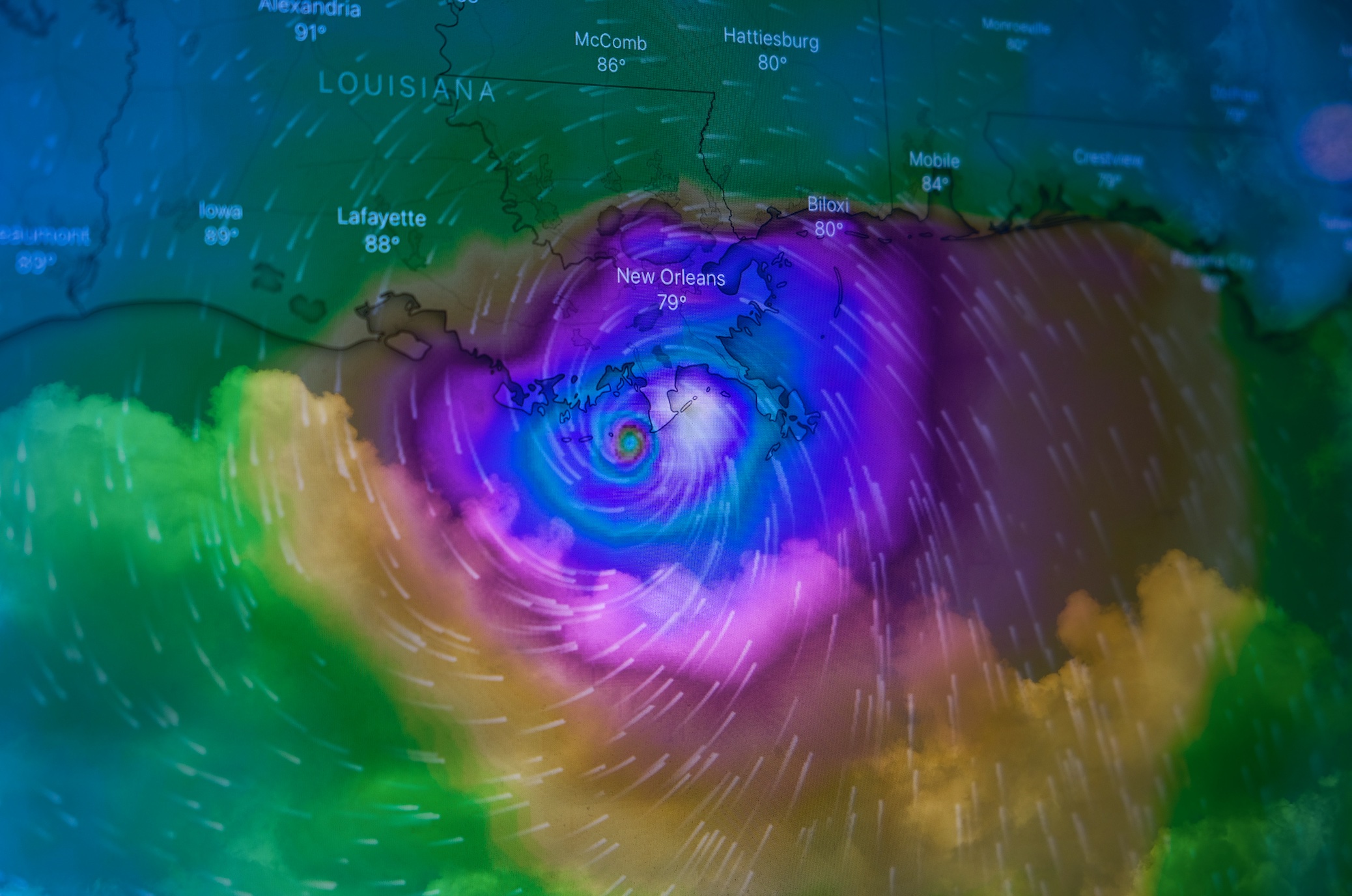

At present, thousands of Louisiana homeowners are still struggling to recover damages from last year’s Hurricane Ida.

On March 29, a federal judge in the Western District of Louisiana awarded $1.7 million in damages to a local businessman who had filed a bad faith insurance lawsuit against Scottsdale Insurance Co, in a dispute over a claim for losses caused by Hurricane Laura in 2020. After a four-day trial, the jury in the Lake Charles Court found that Scottsdale Insurance Co had delayed processing of the claim presented by the owner of Eaux Holdings LLC.

The problem is not new, or uncommon. Many Louisiana policyholders are faced with similar delay tactics. According to the law, once proof of loss is established, insurance companies must settle a claim in 30 days. If they fail to pay and it is determined they did that in bad faith, insurance companies can be slapped with a 50% penalty, under the Louisiana Revised Statute 22:1892.

The Lake Charles Court’s decision to impose stiff bad faith penalties is viewed as a game-changer for both parties. While insurers in the state moan about the financial losses they have sustained over the past few years, homeowners throughout the state can hope insurance companies will be moved into action.

“With so few insureds stepping up, fighting, and hiring a specialist to assist them, insurance companies just play the shuffle game and wait until the legal time period expires on the insured’s claim. At that point, they are off the hook, no matter how bad the insurance company adjusts the loss,” Brian Houghtaling of the Houghtaling Law Firm, LLC, told Law360. With over 20 years of experience in the field, Houghtaling handled thousands of property damage insurance claims and knows everything about the delay and underpay tactics insurers in Louisiana use.

At present, thousands of Louisiana homeowners are still struggling to recover damages from last year’s Hurricane Ida. Under Louisiana law, homeowners have 180 days to file a claim and submit proof of loss. The main problem is that insurance companies in Louisiana have been increasingly using a technique known as adjuster shuffle or adjuster churning.

When you file a hurricane damage claim, the insurance company must send an adjuster to assess damages to the property. After a major disaster, like Hurricane Ida, the waiting times are already long. You finally get a visit from the adjuster, only to be told soon after that a new adjuster has been assigned to your case, which practically brings your claim back to the starting point. And then another, and another. In south Louisiana, homeowners have seen 5 and even 7 adjusters assigned to their cases.

Insurance companies put this shuffle on personnel shortages, but seasoned insurance claims lawyers in Louisiana call it by its real name – bad faith. If the 180 days are up, there’s little the policyholders can do, as Houghtaling explained. People just give up on their claim or accept whatever money the insurer cares to throw their way.

While this is understandable, it is also wrong. As the verdict in the Eaux Holdings case proves, insurance companies can be brought to justice and punished for their bad faith practices.

Property damage claims lawyers expect insurance companies in Louisiana to accelerate processing times and cut back on delay tactics to avoid being sued for bad faith. The 50% bad faith penalty is reason enough, not to mention that Louisiana Insurance Commissioner Jim Donelon is working on a bill addressing the problem of insurance adjuster churning.

If you’re wondering where I can find attorneys near me, the answer is simple. Just follow the link, click on the practice area you’re interested in and select the city you live in, to discover the best attorneys close by.

If you have a problem with your insurance company in south Louisiana, schedule a free consultation with a reliable lawyer at the Houghtaling Law Firm, LLC in Metairie, and let them help you deal with your insurer.

Join the conversation!