Tax attorney is convicted of tax evasion and submitting fraudulant returns to the IRS.

It might go without saying that former tax attorney, Scott C. Cole, knows how to beat the system. After all, he made a profession of representing individuals in sticky situations over their taxes. But, it finally caught up with him after he was sentenced to 30 months in prison for pleading guilty to tax evasion of more than $2.4 million.

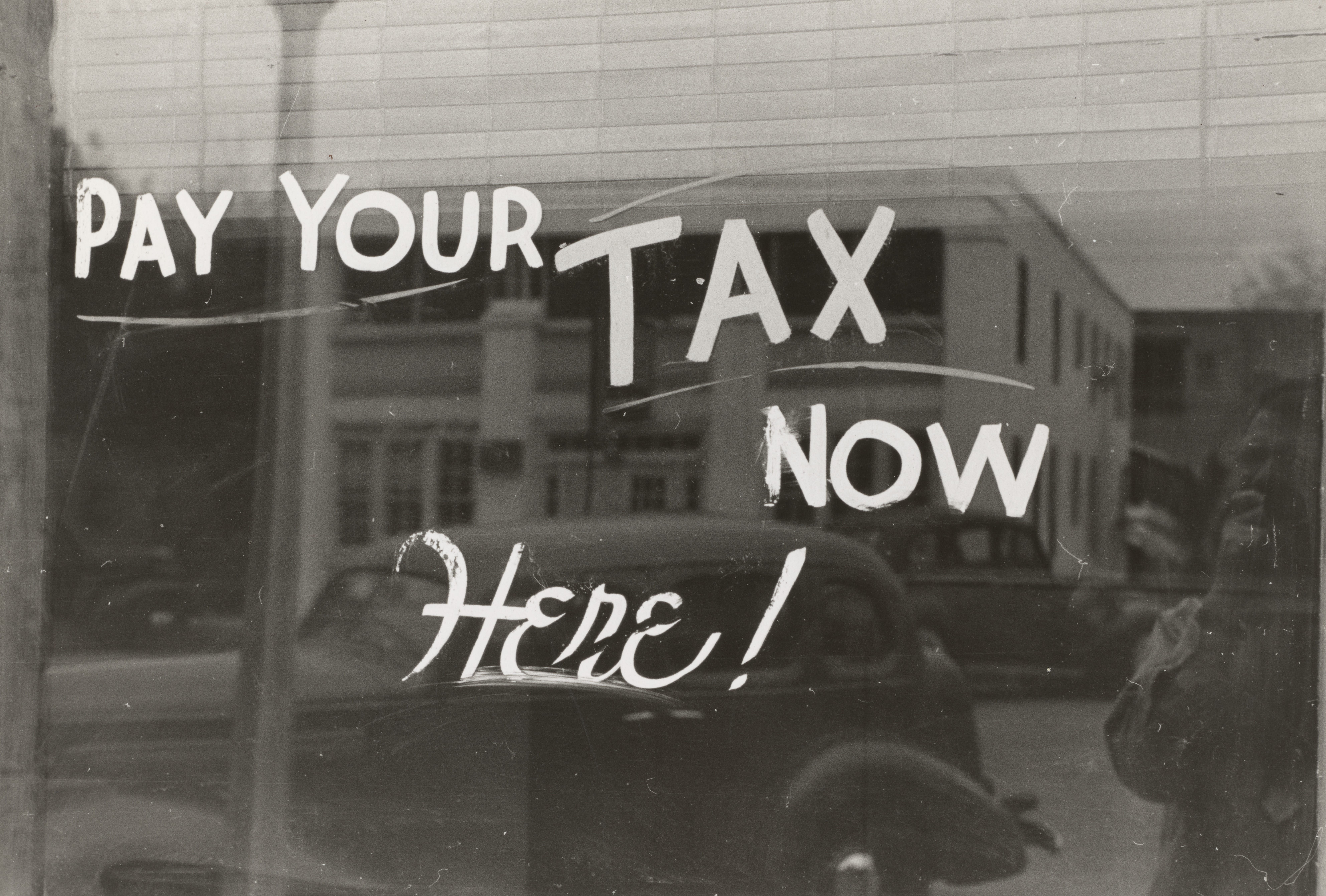

U.S. Attorney Josh Minkler for the Southern District of Indiana said Cole “intentionally and purposely used his ‘expertise’ to repeatedly obstruct the Internal Revenue Service and to evade his federal tax obligations.” He added, “We all have an obligation to pay our share of taxes to keep our government operating. Those who choose to steal from the government and expect others to carry the tax burden will be held accountable.”

Scott and his brother Darren T. Cole formed a partnership called the Bentley Group on February 2, 1998. The tax attorney created limited liability companies, prepared corporate and individual tax returns, and represented clients before the IRS. But, business was reportedly not so hot in the first few years, so Cole came up with a way to increase profitability. He ultimately resigned from the Indiana bar in 2014 after a complaint was filed against him for submitting fraudulent tax returns two years in the row, 2001 and 2002.

“Cole has a complete lack of respect for the law, for the tax code, his fellow citizens and for the court,” said Chief Judge Jane Magnus-Stinson, adding, “Cole will serve two years of supervised release after his prison term and pay full restitution to the federal government.”

The U.S. Department of Justice reported, “Cole was an attorney and preparer of tax returns. As the result of Internal Revenue Service (IRS) audits of Cole’s 2001 and 2002 tax returns, the Tax Court and the United States Court of Appeals for the Seventh Circuit determined that Cole owed over $1,000,000 in taxes and penalties, stemming from Cole’s fraudulent omission of over $1.5 million of income from his individual tax returns for those years. From 2011 through 2017, when the IRS sought to collect those taxes, Cole took various steps to evade payment of his tax debt. His efforts included opening bank accounts in the names of nominees, such as family members, directing payment for legal and tax preparation services performed by him be made payable to nominee companies he controlled, paying personal bills from bank accounts maintained in the names of nominees, and dealing extensively in cash and money orders. Cole also prepared tax returns for clients that omitted his name as the paid preparer of those tax returns, a violation of the Internal Revenue Code and related regulations. Because of Cole’s acts of evasion, the IRS collected less than $3,000 of the total tax debt Cole owed for the 2001 and 2002 tax years.”

Minkler explained further, “Cole attempted to evade and defeat tax payments by opening bank accounts with sham company names and directed payment for services he rendered to the same artificial companies. He paid personal expenses through third-party business accounts, dealt extensively in cash and filed false 1040 tax returns understating taxable income.”

Sources:

Former tax lawyer from Brownsburg sentenced to 30 months in prison for tax evasion

Former tax attorney sent to prison for tax evasion of over $2M

Join the conversation!