6/16/2015

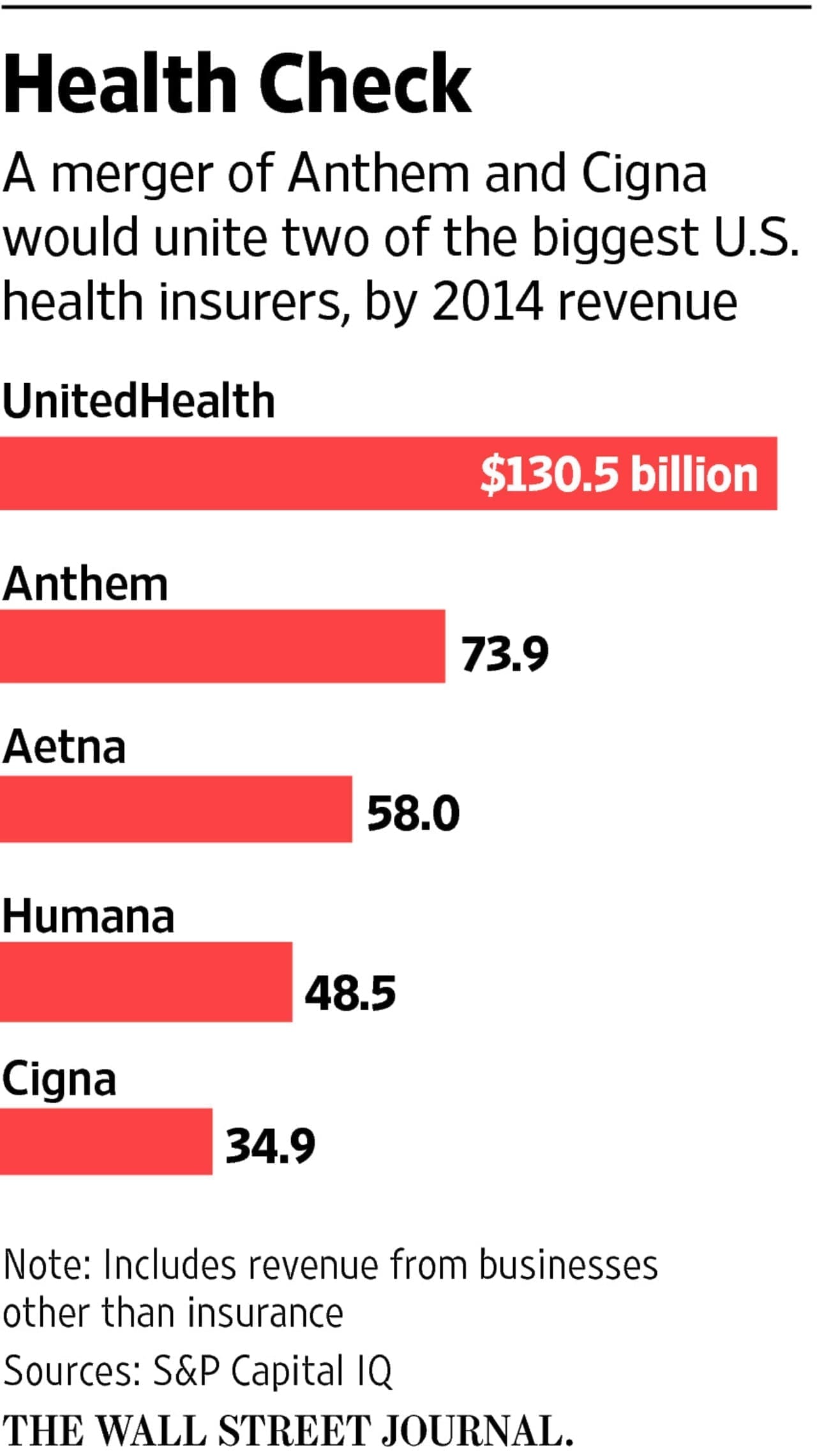

It appears that the wave of high-level consolidations in the business world has now carried over to the nation’s top health insurers. United Healthcare, by far the industry leader, has approached Aetna, the U.S.’s third-largest health insurer, this week in early discussions of a merger. Anthem, the country’s second-leading health plan provider has also spent the past few months in discussions with the fifth-largest insurance company, Cigna, which specializes in small-business plans, although Cigna has so-far fought off the potential acquisition. For its part, Aetna has also explored a purchase of Humana, the fourth-largest health insurer. Humana holds a lucrative portion of the market on Medicare Advantage, a private health plan that offers more thorough coverage than traditional Medicare. To complicate matters even more, Cigna has also explored a potential purchase of Humana, and United Healthcare is also considering purchasing Cigna along with Aetna as well as well as Anthem exploring a possible purchase of Humana.

This unprecedented wave of potential consolidation is largely a reaction to the changing face of the health insurance market. While the market for private employer health plans has leveled off, the massive influx of new enrollees and strict requirements of government health care due in large part to the Affordable Care Act (ACA), or Obamacare, has made consolidation a much higher priority. Although the ACA has created a boom in the industry according to Wall Street, with insurance stocks at a peak, the ACA requires insurers to spend at least 80 percent of its premiums on medical claims, creating a thinner overall profit margin. As the large increase in ACA enrollees levels off, insurers must now focus on cutting costs, which is likely the major catalyst in the rush to merge. Additionally, hospital mergers have increased to over 100 in 2014 from 50 in 2009, the final pre-Obamacare year, in an effort to manage costs in the wake of the ACA. The consolidation should give the insurers additional leverage in negotiating rates with the larger health providers.

Also, Humana and Cigna have become increasingly valued, due to the Humana’s Medicare Advantage stranglehold and Cigna’s lucrative foreign market. Humana controls about 20 percent of the Medicare Advantage market, which accounts for about $150 billion, or 25 percent of the $600 billion in total Medicare reimbursements. Cigna, meanwhile, dominates the market for insuring U.S. employees who work internationally as well as selling insurance in foreign markets like Korea. If the top two insurers fail on their bids to purchase Cigna and Humana, a possible merger between the two could create an additional top-tier powerhouse. Aetna executives, meanwhile, have been very vocal about their desire to make a deal, although it is unclear whether it will be a buy or a sell as its market share will likely need to be increased to avoid being left behind in the dust of other consolidations.

Although all signs indicate that some rearrangement between the five insurers is inevitable, finding the right combination that satisfies all parties may become tricky. Humana and Cigna, despite being the smallest of the providers, likely hold the keys to the entire industry. Both companies will demand top-dollar for a sale, with Cigna already rebuffing Anthem’s latest offer, estimated to be over $175 per share, or $45 billion. Despite the failed negotiations, there does appear to be the will to get a deal done. Analyst Chris Rigg explains, “Strategically the transaction would improve the competitive position of both concerns.” Anthem holds the Blue Cross/Blue Shield license for 14 states, and the acquisition of Cigna would move the insurer closer to United Healthcare’s dominant market share.

While Humana’s Medicare Advantage market share also makes it an attractive partner, there is some concern about allegations regarding an industry-wide price-fixing scheme involving the risk-formulation of Medicare Advantage plans, ensnaring both Humana and Anthem. The Pulitzer prize-winning Center for Public Integrity (CPI) has filed a lawsuit under the Freedom of Information Act, and may pursue additional legal action regarding the scheme. There is also some regulatory concern about the merging of Anthem and Humana, as the insurers would have some overlapping territory that would need to be reworked. Likewise, a United Healthcare-Humana merger could raise antitrust concerns due to the market size of the two providers’ Medicare markets. These concerns give Aetna the inside track on a deal with Humana, although the dust will likely have to settle to see how the remade industry will ultimately shake out. However the eventual fallout, it would appear that the market is about to undergo, as Rigg puts it, “crazy times.”

Sources:

Bloomberg Business – Zachary Tracer and Ed Hammond

Guardian Liberty Voice – Dyanne Weiss

Wall Street Journal – Dana Cimilluca, Dana Mattioli, and Anna Wilde Mathews

Join the conversation!