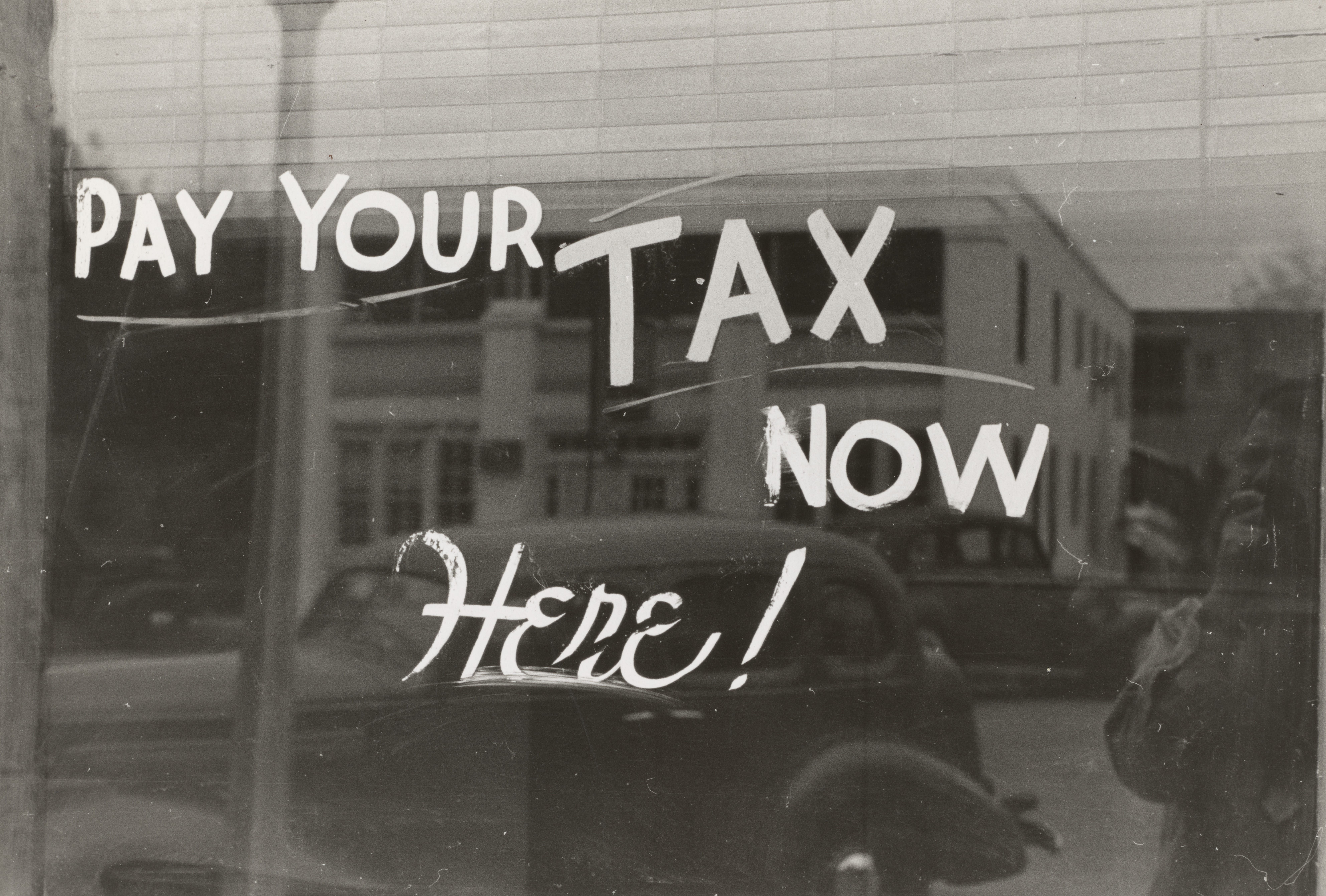

Once taxes are late, the federal government will add monthly fees and annual interest.

Kansas City, MO – While the deadline for taxes is around the middle of April annually, many people do not have their taxes prepared and ready to send out at this time. If the deadline is missed, the taxes can still be paid without any serious consequences, however it is important to realize that there are late fees and a person will generally owe more money as their tax debt remains outstanding for several weeks or months after the deadline. Lawyers can be retained by people who have significant tax debt and the fear of enforcement actions being taken by the IRS.

Filing for an extension is important

Extensions are available to people who are not ready to pay. taxes. This means that anyone who will not be filing their taxes by the April deadline absolutely needs to request an extension with the government. This is a crucial step because it lets the government know that the taxes will be filed and paid, but the individual simply needs more time and is not trying to avoid payment or engage in fraud.

Even if the government grants the extension, this does not prevent fines and interest being added to the person’s tax bill. The taxes are still technically due at the announced deadline date, and the extension is more of a procedural requirement than a step to avoid fees on late taxes. Kansas City tax lawyers are a good source of information for those who have missed the deadline and need assistance with staying out of trouble with the IRS.

Tax fees can start to add up

Once taxes are late, the federal government will add monthly fees and annual interest. While a person who pays their taxes a few weeks after the deadline may not notice much of a difference, it is important to know that these fees can really start to add up as unpaid taxes linger, especially if the person started with a large tax bill. Missouri tax lawyers often work with people who owe the government a lot of money to settle their unpaid taxes for a lesser amount. Tax lawyers who are skilled negotiators may be able to save their clients large sums of money in some situations by simply getting the government to agree to take a smaller amount from the person if they are having trouble paying.

Consider tax consequences other than income

Those who have other interests in things like real property and investments should be mindful of these items when filing taxes as well. Estate planning lawyers routinely give advice to people about trusts, wills, investments, and other ways of maintaining and transferring wealth to charitable causes and between family members.

More help is available

USAttorneys.com is a referral service that connects people with lawyers who can solve their problems. Anyone who needs to speak with a licensed attorney in their area can call 800-672-3103 to get connected.

Join the conversation!