Overall, according to the March report by the Organisation for Economic Co-operation and Development, it is predicted that the global economy will grow by 2.4% in 2020 instead of meeting the 2.9% growth figure projected earlier.

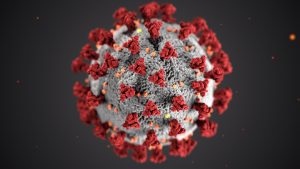

Back in December 2019, the first case of a new virus was registered in Wuhan, China. Four months later, COVID-19, more commonly known as Coronavirus, has spread across the world and turned into a global pandemic.

As of now, Coronavirus has taken over the world. According to the most recent updates published by the World Health Organization, over 462,000 people were infected in over 110 countries around the world, and more than 21,000 cases of infection resulted in death.

However, it is not only lives that COVID-19 has been taking. After the World Health Organization officially declared the outbreak a pandemic, world leaders were encouraged to have all countries continue efforts that have been effective in limiting the number of cases and slowing the spread of the virus. Thus, in an attempt to flatten the curve and slow down the alarming rate at which the virus is currently spreading, governments of the countries across the world have been taking extreme containment measures. A number of countries have imposed partial restrictions on the activity carried out by people, while others such as China, Italy, Spain, Ukraine, India, the U.S., and the UK went into the complete lockdown. This means that schools and most businesses apart from those considered to be essential are closed. At the moment, there is still no vaccine or cure found to fight against COVID-19, so the implications are that there is no foreseeable end to the rise in the new cases of Coronavirus infections.

Naturally, such changes have immediately caused a lot of disruption in the regular lives of people and even more so in the economies of countries. The International Monetary Fund states that the global recession caused by Coronavirus in 2020 will be at least as bad as the downturn during the financial crisis back in 2008. However, a lot of specialists are already making even more alarming estimates that the recession that we are standing at the brink of will be comparable to the Great Depression of the 1920s.

So far, the main areas of global economies that were affected by the spread of COVID-19 include manufacturing activity and the associated employment, services, oil industry, and subsequently oil prices, stock markets and bonds, and the overall economic forecasts.

A downturn in the manufacturing activity

One of the largest effects of the nationwide lockdowns in countries across the world aimed at the slowdown of the virus spreading is a major downturn in manufacturing activity.

At first, the manufacturing sector of China was hit with the virus outbreak back in February 2020. Now, the Caixin/Markit Manufacturing Purchasing Managers’ Index reflected on the fact that China’s factory activity came in at a record-low reading of 40.3, which indicates contraction. This had a massive negative effect on the countries that have close links with China and rely on Chinese manufacturers.

However, now that many more countries are going into mandatory quarantine and are temporarily shutting down factories, the same results can be expected to appear worldwide. Moreover, granted that China, after partially combatting the outbreak, is taking a much longer time to resume manufacturing operations, it is possible that the international manufacturing activity could remain subdued for longer.

Unemployment

Another major problem imposed by the spread of the deadly virus is the surging rates of unemployment. While the governments of a number of developed countries such as the U.S. and the UK are trying to encourage businesses to keep their workers instead of making them redundant by offering various government incentives, there are numerous countries that cannot support small businesses and those, in an attempt to not go bankrupt during the virus, are firing employees.

Service contraction

Service is yet another sector heavily affected by COVID-19. Due to the fact that a lot of people are fastening the belt in the face of a significantly more limited disposable income available to them, the retail industry, restaurants, and travel industry are suffering.

Perhaps, the biggest losses caused by Coronavirus are experienced by the airlines. At some point in time, it was possible to book a domestic flight for as little as $4, the mere cost of a Venti latte at Starbucks, or a transatlantic flight for roughly $250. However, even with prices as low as people were not willing to take those flights. The governments advised people to avoid all non-essential travels, conferences, festivals, and concerts (most of which were canceled), and people themselves were not willing to catch flights due to the scares of getting infected. That was before the closing of borders in numerous countries across the globe. Now that the airspace is closed, the International Air Transport Association (Iata) trade body calculates that revenue worldwide this year could decline by between $63bn and $113bn, or as much as 20%.

A decline in oil prices

All of the aforementioned has resulted in a global reduction in the demand for oil. This, in turn, brought the world to the lowest oil prices in the past 17 years.

The crash of stock markets

Concerns surrounding the future of businesses after the major virus outbreak led to an unprecedented drop in the prices of stocks, the biggest in the last couple of decades. Coronavirus caused the largest one-day drop of stock prices and resulted in a massive stock market plunge: The Dow Jones Industrial Average fell almost 3,000 points.

A plunge in economic forecasts

Last but not at least, the overall forecasts for global economics were released by major institutions around the world. It is estimated that in 2020, the gross domestic product growth will be much lower than previously predicted with some countries suffering the economic consequences of the virus outbreak more than the others. For instance, China saw the largest downgrade in terms of magnitude, as the current expected growth rate is 4.9%, which is 0.8% lower than the earlier forecast of 5.7%.

Overall, according to the March report by the Organisation for Economic Co-operation and Development, it is predicted that the global economy will grow by 2.4% in 2020 instead of meeting the 2.9% growth figure projected earlier.

Join the conversation!