The American Rescue Plan forbids recipient states from using relief funds to offset net tax losses.

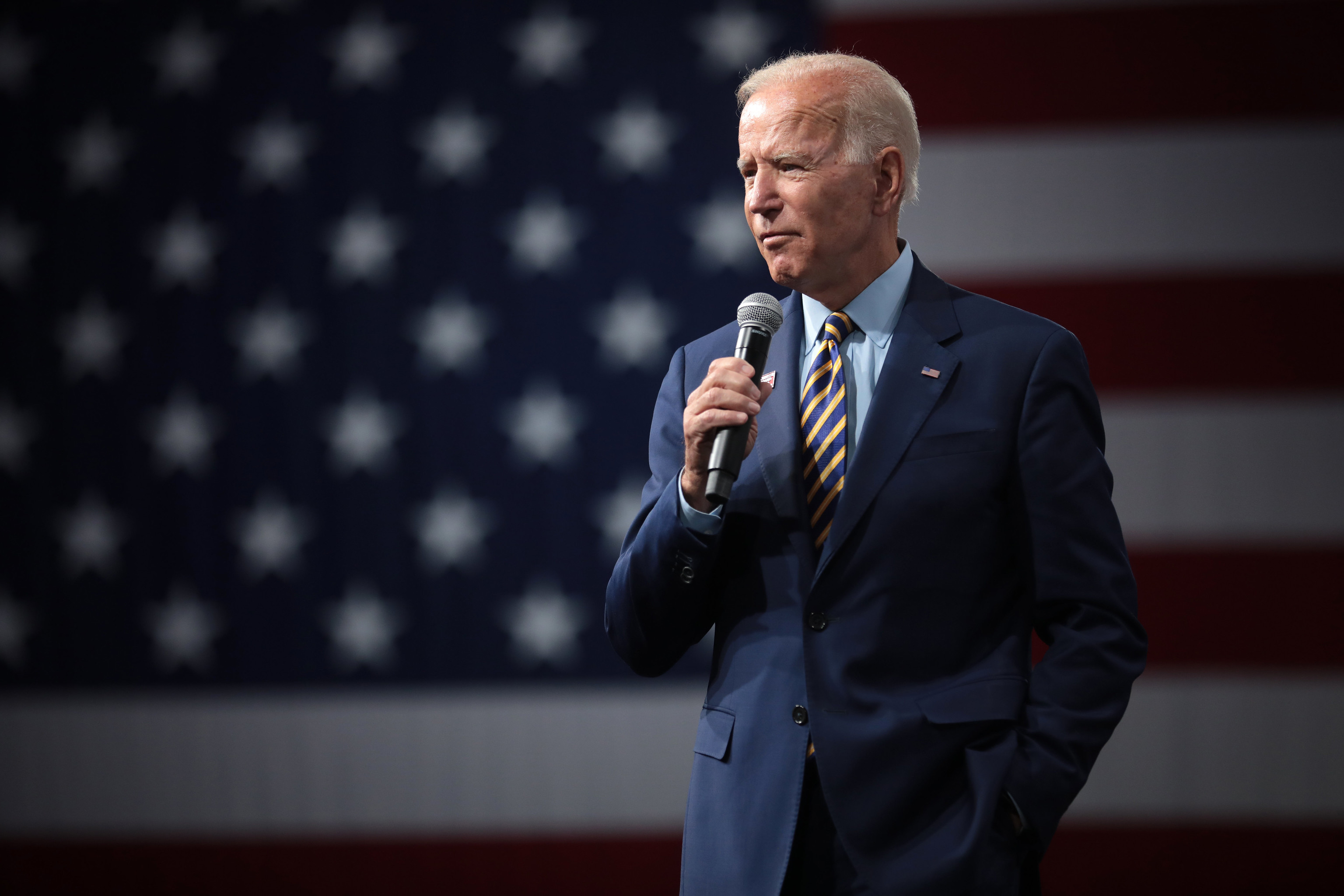

Attorneys general from more than a dozen states have filed a lawsuit against the Biden administration.

The New York Post reports that the lawsuit takes specific issue with an aspect of the recently-enacted, $1.9 trillion coronavirus relief law. The legislation, notes the Post, broadly prohibits states from using relief money to lower taxes.

Filed in U.S. District Court in Alabama, the lawsuit requests that the court invalidate that provision of the American Rescue Plan.

Under the Plan’s current provision, states cannot use some $195 billion in federal funding to “either directly or indirectly offset a reduction in the net tax revenue.”

The restriction could continue in effect until 2024.

“Never before has the federal government attempted such a complete takeover of state finances,” West Virginia Attorney General Steve Morrisey said in a statement. “We cannot stand for such overreach.”

Similarly, Kentucky Attorney General Daniel Cameron said that every state has the right to set its own tax policy without federal interference.

“Kentuckians expect state tax policies to be set by the men and women they elect to represent them in the General Assembly, and not as a result of an edict from the Federal Government,” said Attorney General Cameron. “These COVID relief funds are essential to helping the Commonwealth and hardworking Kentuckians recover from the effects of the pandemic, and it is unconstitutional for the Biden Administration to hold the funds hostage if we don’t agree to Washington’s preferred tax policies.”

According to The New York Post, the lawsuit comes two weeks after another 21 attorneys general sent a letter to the Department of Treasury asking how the Biden administration was planning to interpret the tax provision.

They asked, for instance, whether states which accept coronavirus relief funds would be prohibited from lowering taxes for any reason, or if the law simply prevents states from using coronavirus relief to offset new tax cuts.

Treasury Secretary Janet Yellen later confirmed the administration’s intent, saying the law was not intended to be a “blanket moratorium” on tax cuts.

“Nothing in the Act prevents States from enacting a broad variety of tax cuts,” Yellen said. “It simply provides that funding received under the Act may not be used to offset a reduction in net tax revenue resulting from certain changes in state law.”

However, Attorney General Morrisey has claimed the language of the law—especially the inclusion of the word “indirectly,” as it relates to tax cuts—could create problems years down the line.

“This [lawsuit] ensures our citizens aren’t stuck with an unforeseen bill from the feds years from now,” Morrisey said in a statement.

The attorneys general stressed that Yellen’s response did not adequately address any legal consequences of the word “indirectly.”

Sources

Biden administration sued by 13 states over tax provision in COVID-19 relief plan

Tennessee, Kentucky File Lawsuit against Biden Administration State Tax Policy

Join the conversation!