Remember to be polite, be firm, and provide only the bare essentials.

The moments after an accident are overwhelming. Your body is in pain, your mind is racing, and your life has been abruptly disrupted. Then, the phone rings. It is the other party’s insurance adjuster, and while they may sound friendly, this call is far more than a simple check-in. This conversation is a critical event that can define the outcome of your claim. Being unprepared for this interaction can significantly compromise your ability to receive fair compensation for your injuries and damages.

The first conversation with an insurer is a strategic one. According to legal experts, the first 72 hours after an incident are pivotal, as insurance companies move quickly to gather statements that can limit their liability. The adjuster’s primary job is to protect their company’s bottom line, not to ensure you receive the maximum compensation you deserve. Understanding their goals and knowing how to respond is your first line of defense in protecting your rights and financial future.

The Adjuster’s Playbook: Understanding Their Goals and Tactics

When an insurance adjuster calls you, it is essential to remember who they work for. They are employees of the insurance company, and their performance is often measured by how effectively they can minimize payouts on claims. This reality shapes every question they ask and every tactic they employ. Recognizing their playbook is the first step toward leveling the playing field and protecting your interests.

Their Primary Objective is Not Your Full Recovery

Insurance adjusters are trained negotiators working within an industry facing rising costs and aggressive litigation, which puts a strain on insurers. Their goal is to close your file as quickly and cheaply as possible. They are not your advocate, and their friendly demeanor is a professional tool used to build rapport and encourage you to share information. Amid a surge in attorney-led claims, insurers are often pressured to secure statements from you before you have the chance to obtain legal counsel. This urgency is driven by data showing that attorney involvement often leads to higher claim severity, which directly impacts an insurer’s financial reserves.

Common Traps and Questions to Anticipate

Adjusters use several common tactics to gather information that can weaken your claim. One frequent strategy is to offer a quick, lowball settlement before the full extent of your injuries and damages is known. While tempting, accepting this initial offer often means forgoing compensation for future medical bills, lost wages, and long-term suffering. Another key tactic is requesting a recorded statement. This locks you into details before you have all the medical facts or the official accident report. Adjusters may also try to attribute your pain to a “pre-existing” condition to deny responsibility for the new injury. As detailed in 5 Insurance Adjuster Questions That Can Hurt Your Houston Claim, these questions are designed to steer you into statements that reduce the value of your claim.

How Your Words Can Be Used Against You

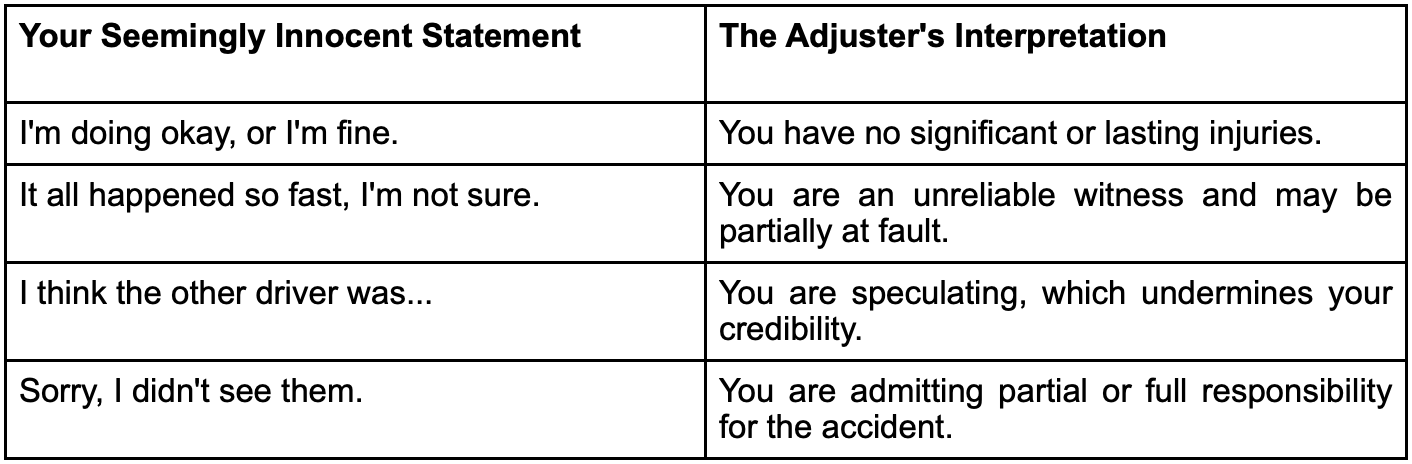

Even seemingly harmless pleasantries can be twisted and used to undermine your claim. Adjusters are trained to listen for any statement that implies you are not seriously injured or that you might share fault for the incident. Every word matters, and what you say can be taken out of context in official claim notes and reports. It is crucial to be mindful of how your statements can be interpreted.

What to Say and What to Avoid in Your First Conversation

Now that you understand the adjuster’s objectives, you can prepare a clear and simple script for your first interaction. The key is to be polite but firm, providing only the most basic information required to identify yourself and the incident. This approach prevents you from unintentionally harming your claim while still complying with the initial contact.

Stick to the Script: Provide Only Basic Information

During the first call, you are only obligated to provide fundamental identifying details. You should state your full name, address, and phone number. You can also verify when and where the accident happened. Do not volunteer any additional information, even if the adjuster asks friendly, conversational questions. Keep your answers brief, factual, and limited to these core pieces of information. This disciplined communication ensures you do not say anything that could be misconstrued later on.

Critical Information You Must Withhold

Protecting your claim is as much about what you don’t say as what you do. There are several topics you should politely refuse to discuss during the initial call. An adjuster may pressure you for these details, but you have the right to decline until you are prepared and have sought counsel. Be firm and consistent in withholding this sensitive information.

- Do Not Discuss Fault. Never apologize, accept blame, or even speculate on what caused the accident. Just note that the incident is still being investigated. Any admission of fault, even a simple I’m sorry, can be used to assign you partial or full responsibility.

- Do Not Give a Recorded Statement. Politely decline any request for a recorded statement. You can say, “I’m not comfortable giving a recorded statement right now.” This prevents you from being locked into an early account of events before all facts are known.

- Do Not Detail Your Injuries. The full extent of injuries is often not apparent for days or even weeks. Simply state, I am still seeking medical treatment and don’t have a full diagnosis yet. This prevents the insurer from downplaying your injuries based on your initial feelings.

- Do Not Discuss Your Medical History. Providing this information gives the adjuster ammunition to claim your injuries are pre-existing. As insurance adjusters often do, they may label your pain as related to a past issue to deny responsibility for the current harm.

- Do Not Accept an Immediate Settlement Offer. The first offer is rarely the best one. Never accept a payout without understanding the full cost of your medical treatment, lost wages, and other damages. Express appreciation for the offer and let them know you’ll revisit it once you have more details.

- Do Not Sign Any Documents. Do not sign medical release forms or other documents without having an attorney review them first. These forms can give the insurer broad access to your entire medical history, not just records related to the accident.

How to End the Conversation

Once you have provided the basic identifying information and politely declined to offer further details, you can end the call. A simple, professional closing statement signals that the conversation is over and that you are in control of the process. You could say: “Thanks for your call. At the moment, that’s all the information I’m able to share. I will be in touch once I have more details, or My attorney will contact you directly.” This leaves no room for further questions and establishes a clear boundary.

When to Bring in a Professional Advocate

Handling an insurance adjuster on your own is a significant risk, especially when you are focused on recovering from an injury. The adjuster has extensive training and resources on their side. Bringing in a professional legal advocate is the most effective way to level the playing field and ensure your rights are fully protected from the start.

The Complexities of a Houston Personal Injury Claim

Houston is a major hub for traffic accidents and workplace injuries, making the legal environment particularly complex. In 2023, the city saw more than 67,000 motor vehicle crashes. Statewide, the Texas Department of Transportation reported that 251,997 people were injured in crashes in 2024personal injury lawyer Houston Texas. Navigating a personal injury claim in this environment requires expertise, especially when dealing with powerful insurance companies that are determined to protect their financial interests. The process is often contentious, and a single misstep can jeopardize your entire claim.

How an Experienced Attorney Protects Your Claim

An experienced attorney immediately takes over all communication with the insurance adjuster. This action shields you from their pressure tactics and manipulative questions. A lawyer knows exactly what information to provide and what to withhold to protect the value of your claim, allowing you to focus on your recovery without the stress of dealing with the insurer.

A skilled legal team will work to calculate the true, long-term cost of your injuries. This calculation includes future medical bills, lost earning capacity, and pain and suffering, ensuring you don’t accept a lowball offer that leaves you financially vulnerable down the road. In Texas, the gap between the median personal injury award ($12,281) and the average verdict ($826,892) highlights how unrepresented claimants can be significantly shortchanged. This disparity underscores the value of having a professional advocate who can accurately assess a claim’s worth and negotiate from a position of strength.

For those injured in Harris County, retaining a board-certified personal injury lawyer Houston Texas, is a crucial step toward securing fair compensation. A reputable firm like the Law Office of Shane R. Kadlec brings over two decades of experience to the table, managing the entire legal process so clients can focus on their physical and emotional recovery. They build a robust case by gathering all necessary evidence, consulting with experts, and negotiating forcefully on your behalf to counter the tactics used by insurance companies.

The Financial Advantage of Legal Counsel

Many people worry about the cost of hiring a lawyer, but most personal injury attorneys work on a contingency fee basis. This means you pay nothing upfront. The attorney’s fee is a percentage of the compensation they successfully recover for you. If your case isn’t successful, you won’t owe any attorney’s fees. This arrangement gives you access to high-level legal expertise without any financial risk. It also aligns your attorney’s goals directly with yours: to secure the best possible outcome for your claim.

Protecting Your Rights Begins with Your First Words

The first call with an insurance adjuster is not a casual conversation but a strategic moment that can set the tone for your entire claim. By understanding their objectives, limiting the information you share, and knowing when to end the conversation, you place yourself in a position of power from the very beginning. This proactive approach helps safeguard your ability to pursue the full and fair compensation you need.

Remember to be polite, be firm, and provide only the bare essentials. You are not obligated to tell your whole story or make any immediate decisions. Taking control of this initial interaction is the first and most critical step toward ensuring you receive the resources needed to rebuild your life after an injury. Do not hesitate to state that your attorney will be in contact, which signals that you are serious about protecting your rights.

Join the conversation!