Filing for bankruptcy is a big decision, and you should make sure that you are prepared to handle it. Your attorney will help you understand the legal issues that arise from undergoing this process.

Bankruptcy law is a specialized area of law that requires the expertise and education of lawyers who are willing to deal with the various circumstances that can arise when a debtor is no longer able to pay debts or even make monthly payments on loans, credit cards, and other financial obligations.

But why and when should you contact an attorney to help handle your situation?

- Ensure Paperwork is Complete

When filing for bankruptcy, your credit will suffer, which means you’ll be a higher risk to lenders. Robert Vandiver explains that filing for bankruptcy is a huge step, and having someone knowledgeable about the process on your side can be a huge relief. However, here are many people who will suggest that it’s not a wise idea to hire a bankruptcy attorney. They believe that you can handle your finances on your own. This is true if you have some experience with finances and you know what to do.

Filing for bankruptcy is complicated. You’ll need to prepare and submit documents and proof of your obligations and financial incapacity. A lawyer so can review the paperwork for you and make sure that everything’s complete.

- Discuss Legal Issues

If you wait too long to contact a lawyer, you’ll miss out on the chance to learn more about your situation, find alternative options, and ensure you have all the required documents. For example, you may realize later on that there was a mistake made in your filing and you may need to file again. A lawyer can help prevent this from happening.

Additionally, there are many legal issues that arise from filing for bankruptcy. These legal issues can be a bit complicated, and you’ll need the advice of a lawyer who specializes in these areas of the law.

- Get Help with Debt Negotiation

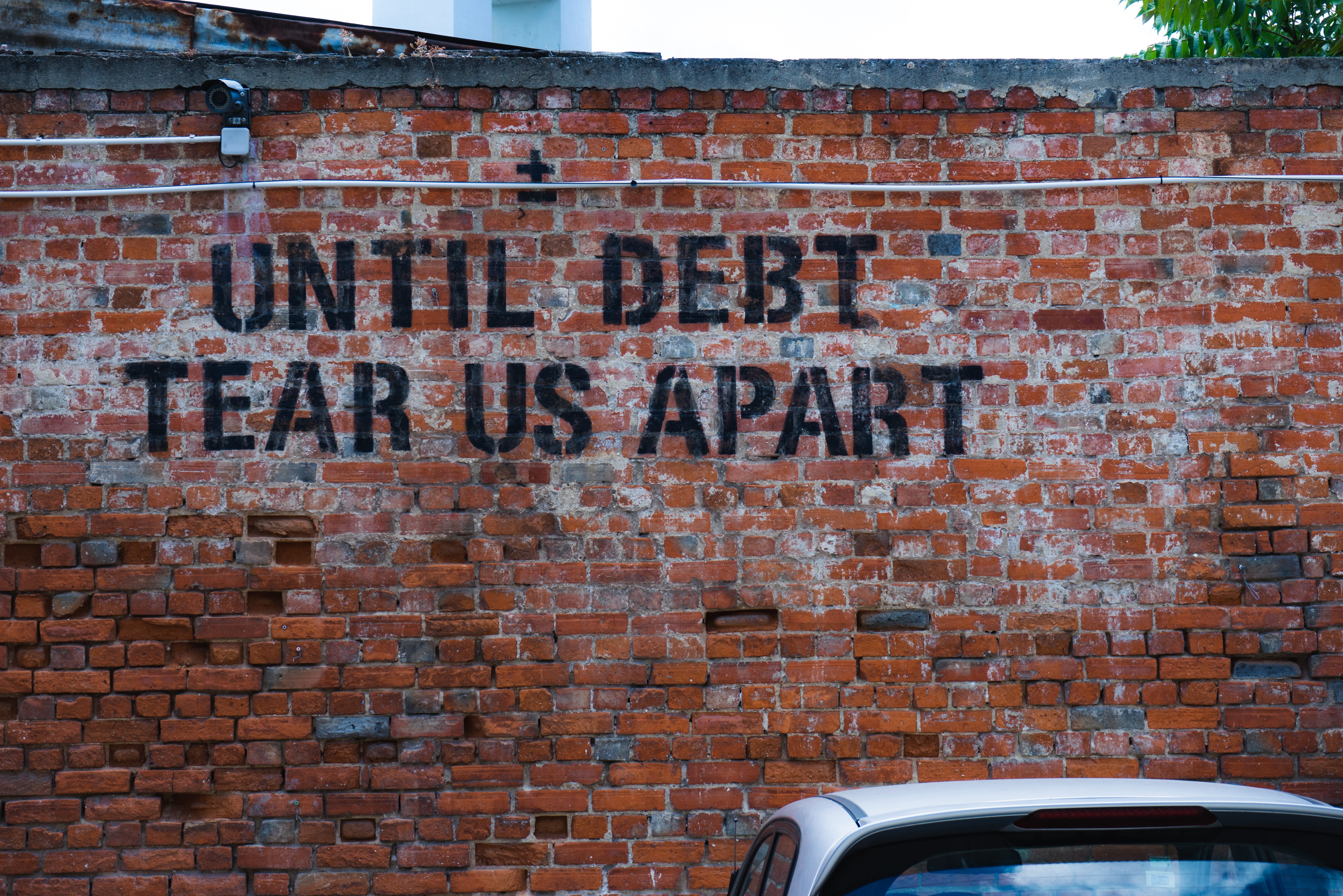

Student debt graphic; image courtesy of 905513 via Pixabay, www.pixabay.com

Filing for bankruptcy doesn’t extinguish certain types of types of debt. You’ll realize that you may still need to settle your obligations with some of your creditors. One good way to handle these types of debt is to get the best interest rate possible for your debts. Debt negotiation is a legal way to pay less for your debts, while making sure your creditors still get what is due to them. However, negotiating with creditors can be time-consuming. You’ll need to get the help of a good bankruptcy lawyer to help you through this process.

- Explain Bankruptcy Law in Layman’s Terms

The best person who can explain bankruptcy law is your lawyer.

There are many different types of debt that can be discharged after filing for bankruptcy, including: mortgages, credit card balances, personal loans, medical bills, and other kinds of unsecured loans. In some instances, bankruptcy law will apply to all debts owed to any individual or entity. In others, the specific kind of debt that is being declared as a result of filing bankruptcy will determine the particular type of bankruptcy law that will apply.

Bankruptcy laws differ from jurisdiction to jurisdiction in different ways. However, for the purposes of this article, you can consider the following as examples of different types of bankruptcy law that may apply to the bankruptcy situation you may be facing:

- Chapter 7 Bankruptcy: Chapter 7 bankruptcy, or liquidation bankruptcy, is very similar to Chapter 13 bankruptcy in that the debtor who files this type of bankruptcy must first declare an inability to meet basic living expenses. After that, the debtor must then file a detailed list of their assets which will then be sold off to pay their creditors. Once all the assets have been sold, and the client has obtained the financial support they require, the court will then order a bankruptcy discharge.

- Chapter 13 Bankruptcy: In Chapter 13 bankruptcy, the court will first determine if there is enough income to support the debtor’s debts. After determining that the debtor does have the means to meet the payments on credit cards and other debts, the court will then determine the client’s ability to pay and if he can continue to make payments in a timely manner. This type of bankruptcy may also be called reorganization bankruptcy.

Chapter 13 bankruptcy allows debtors to declare that they have lost their jobs or have been forced out of a company and will thus be unable to meet their basic living expenses. If the debtor has sufficient income, he will be able to pay off his debts in full and be discharged from other types of debt like unsecured loans.

Conclusion

Filing for bankruptcy is a big decision, and you should make sure that you are prepared to handle it. Your attorney will help you understand the legal issues that arise from undergoing this process. They’ll also provide an expert explanation of bankruptcy law to help you determine what steps you should take to get your finances back on track.

Join the conversation!