The lawsuit alleges that some student loan borrowers may face unexpected–and unwanted–tax obligations.

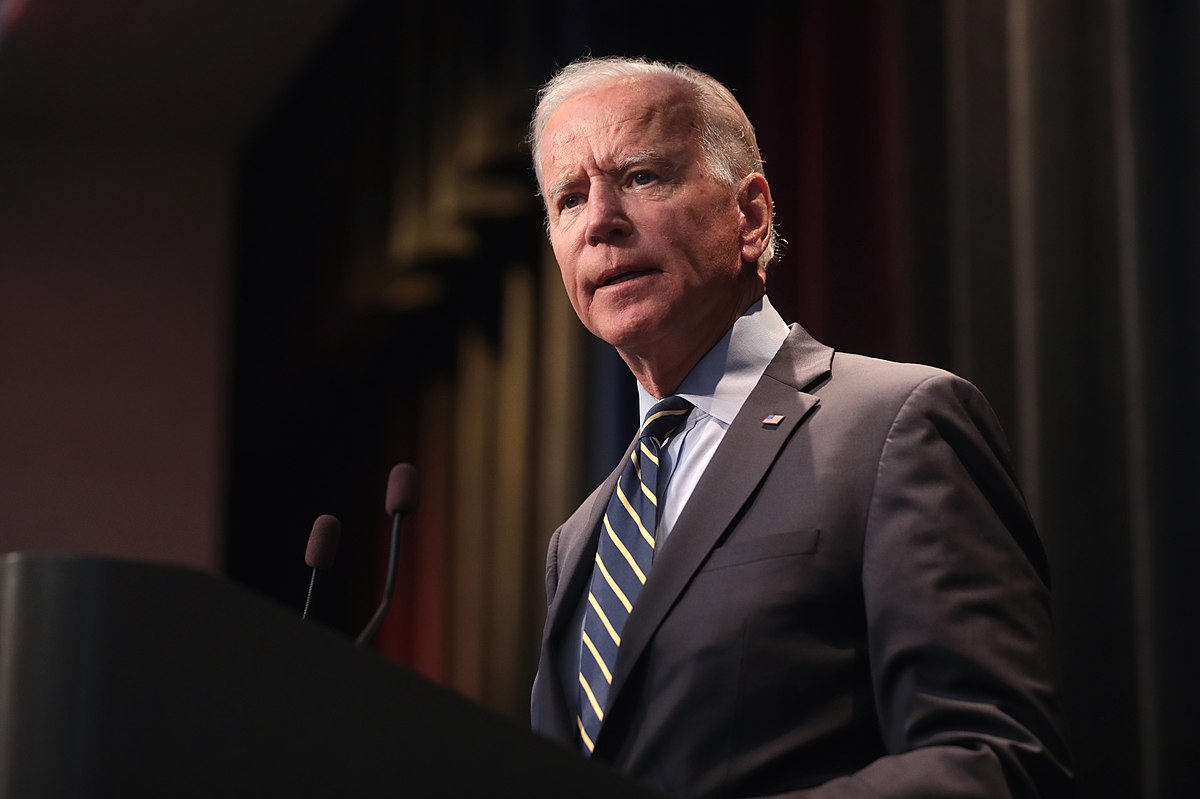

A public policy attorney has filed a lawsuit alleging that President Joe Biden’s student loan forgiveness program is an abuse of executive power.

According to plaintiff Frank Garrison, he—as well as other borrowers—will be forced to pay state tax on the amount canceled.

Garrison claims that, if not for Biden’s plan, he would be able to avoid the expense of an additional, unexpected tax burden.

The lawsuit, which names the federal Department of Education as a defendant, challenges what Garrison terms the agency’s “unacceptable abuse of executive authority.” By filing suit, Garrison hopes to “restore the rule of law and to enforce the Constitution’s separation of powers.”

Under President Biden’s plan, individual borrowers earning less than $125,000 per year in either 2020 or 2021, as well as married couples or heads of households earning less than $250,00 annually in the same years, are eligible to have up to $10,000 in student debt forgiven.

Some recipients, including individuals who had been eligible for the Pell Grant while enrolled in college, could receive forgiveness of up to $20,000.

USA Today notes that the lawsuit is backed by Garrison’s employer, the Pacific Legal Foundation.

“The whole idea that an administrative agency can just say we are going to enact this kind of what they call transformational policy without any oversight whatsoever is ludicrous,” said Caleb Kruckenberg, an attorney with Pacific Legal.

Kruckenberg told USA Today that, because Garrison has already been approved for participation in the Public Service Loan Forgiveness program, he can have his debt forgiven after 10 years.

Garrison, adds Kruckenberg, is already six years into his payments.

However, if Garrison’s debt is discharged, his state of residency—Indiana—will likely charge him $1,000 for having his loans forgiven.

“Congress did not authorize the executive branch to unilaterally cancel student debt,” Kruckenberg said in an additional statement. “It’s flagrantly illegal for the executive branch to create a $500 billion program by press release, and without statutory authority or even the basic notice and comment procedure for new regulations.”

The Foundation’s complaint further alleges that the federal government is, in effect, forcing Americans to embrace an “expensive” change, despite the fact that most student loan borrowers would only stand to benefit from forgiveness.

“This is why the Framers designed the Constitution as they did,” the Pacific Legal Foundation states in a media release. “The separation of powers ensures that no department of government can make unilateral decisions, and that laws come from the body that represents the people: Congress. Even when Congress does the wrong thing, the lawmaking process ensures that the people’s voices are heard. Ramming expensive and divisive programs down the throats of Americans through executive fiat is never a good idea.”

Sources

First lawsuit is filed challenging Biden’s costly, unfair student loan forgiveness plan

New lawsuit attempts to block Biden’s student loan forgiveness plan

Join the conversation!