Some refer to Chapter 13 Bankruptcy as the ‘wage earners bankruptcy.’ This chapter is where debtors offset their loans through an installment repayment process.

You may make a good income but are unable to afford your debts, so you are looking at a Chapter 13 bankruptcy in Texas. Filing Chapter 13 bankruptcy is a big decision. You are committing to a bankruptcy repayment plan that could last for up to five years.

This is why understanding the bankruptcy differences and understanding your Chapter 13 plan payment is crucial to making the most informed decision. Let’s get started.

Chapter 13 Verses Chapter 7 Bankruptcy

The types of bankruptcy can be confusing. Let me first explain the differences between Chapter 13 and Chapter 7. In short, Chapter 7 is often less expensive and faster, so it’s crucial that you understand what you are getting into.

Chapter 13 Bankruptcy in Texas

Some refer to Chapter 13 Bankruptcy as the ‘wage earners bankruptcy.’ This chapter is where debtors offset their loans through an installment repayment process, mostly with the assistance of their lawyers. This plan can last from three years to five years, and it is submitted monthly. Some people earn lots of money that hinders them from filing for Chapter 7, while others possess valuable possessions. These are some of the reasons why they are more eligible for Chapter 13 rather than Chapter 7.

Chapter 7 Bankruptcy in Texas

A Chapter 7 Bankruptcy in Texas can be a much faster bankruptcy than a Chapter 13 bankruptcy.’ This kind of arrangement is handy when debtors can’t pay their debts, forcing them to enter this bankruptcy to be released from their obligation. Chapter 7 can be completed in as little as four months and it is less costly, but you have to be eligible. You have to qualify for Chapter 7 bankruptcy, which makes it more prohibitive.

Calculating Chapter 13 Plan Payments in Texas

Your Chapter 13 plan payment in Texas depends on your specific financial situation, which is why we build a free Texas Chapter 13 Plan Payment calculator below that you can use to estimate your Chapter 13 plan payment.

Factors used when calculating a Chapter 13 plan include, but are not limited to your assets, debts, disposable income, and potentially even recent financial transactions.

Texas Means Testing

You may be wondering what goes into the Chapter 7 Means Test in Texas. The test considers Texas means testing data to give an estimate of whether someone is eligible for a Chapter 7.

The means test helps determine whether you have the means to pay back some of your debt in bankruptcy. Also, we have included information for the Texas Means Test Data from May 15, 2022 inclusive in the table below. Please note that for families with more than 9 people in the household, you would add $9,000 for each additional household member.

That said, you can also take a Texas Chapter 7 means test calculator to help you estimate qualification.

How Much Does it Cost to File Bankruptcy in Texas?

The cost to file bankruptcy in Texas depends on what chapter you are filing. For example, the cost to file a Chapter 7 bankruptcy is $338 and the cost to file a Chapter 13 bankruptcy is $313.

That said, it does not include bankruptcy attorney fees. A Chapter 7 bankruptcy attorney in Texas can charge between $800 and $2000 per case while a Chapter 13 bankruptcy attorney could charge between $2500 and $3825. Those numbers can fluctuate, so it’s best to ask your attorney representative what specifically they charge.

Another helpful question to ask is whether the attorney will take payments for a Chapter 7 bankruptcy.

One of the largest bankruptcy firms that serve Texas is Recovery Law Group. Recovery Law Group appears to charge between $1500 and $5000 to file bankruptcy.

Texas Bankruptcy Exemptions

Before filing for Chapter 13, you have to consider ownership of any assets above the exemptions. Although you might be eligible for a Chapter 7, having an equity position in assets makes filing for a Chapter 13 or debt settlement the better choice.

Texas has particular statutes and bankruptcy exemptions that should be factored in before filing for bankruptcy. If your assets are above the Texas exemptions, they could face liquidation. You can see below the highly common Texas bankruptcy exemptions, but the entire list can be found here.

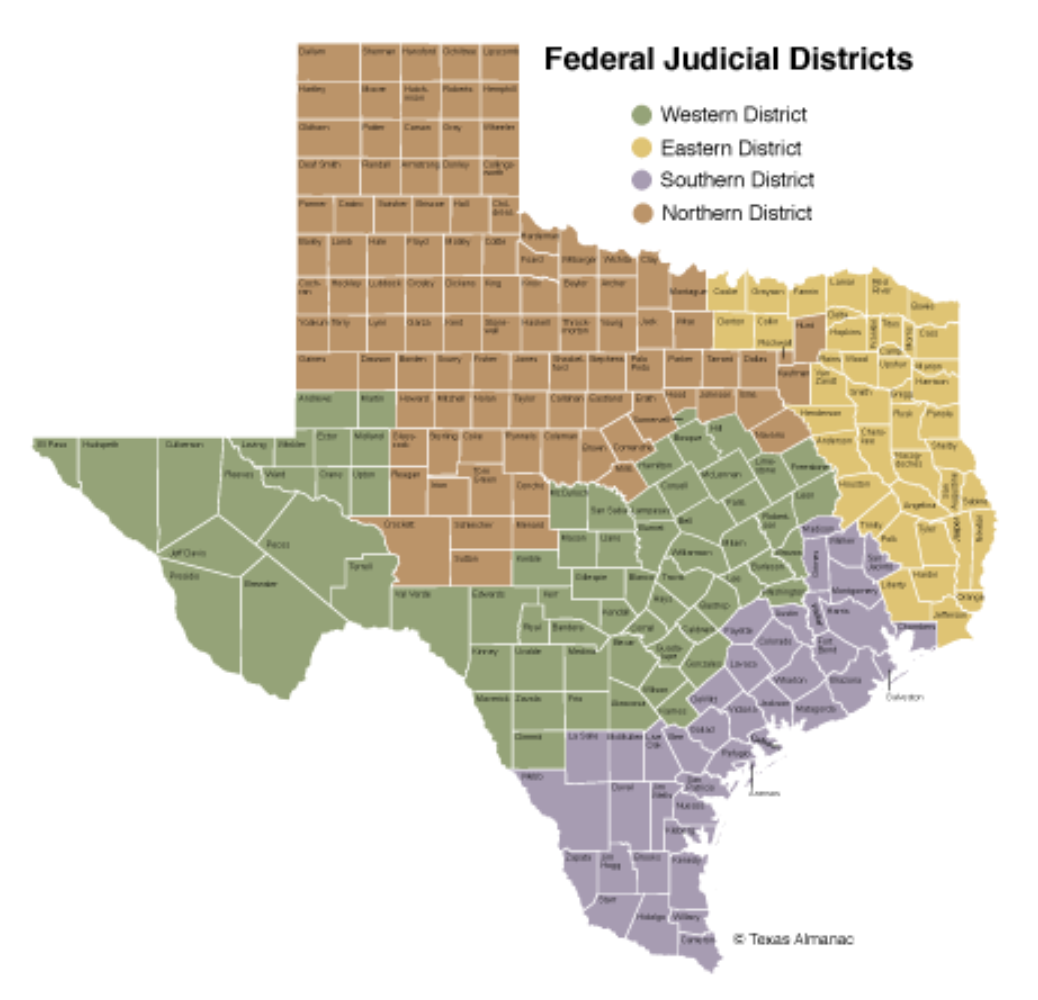

Texas Bankruptcy Districts and Court Locations

You will find 4 bankruptcy districts in Texas: Northern, Western, Eastern, and Southern. The following is a map of the Texas districts from the US bankruptcy courts (Source: Texas Almanac)

Now that you are knowledgeable regarding the districts let’s look at the specific courts you can go to for a Chapter 13 Bankruptcy in Texas. Below are the court websites by the district above.

- Northern District of Texas Bankruptcy Courts

- Eastern District of Texas Bankruptcy Courts

- Western District of Texas Bankruptcy Courts

- Southern District of Texas Bankruptcy Courts

Should I pursue a Chapter 13 Bankruptcy in Texas?

In Texas, a Chapter 13 bankruptcy is an accepted option for people facing debt hardships who aren’t eligible or don’t want to pursue a Chapter 7. You can also look at other options and their cons and pros, including debt management and debt settlement.

A Chapter 13 payment calculator compares the choices and provides the benefits and drawbacks and will estimate your Chapter 13 Repayment Plan. Debt can be a source of continual stress, and hopefully, this article will be instrumental in assisting you to become debt-free.

Join the conversation!