Overall, it is not a complex process to become an independent contractor.

Most businesses or people planning to venture into the business landscape want to be independent contractors. But why? You may ask. Well, this is majorly due to the fact that being an independent contractor comes with a huge degree of freedom. From defining simple things like flexible work schedules to much more complex aspects like defining who your clients are. Now the bigger question here is; How do I become an independent contractor?

Basically, there are several steps you need to follow if you are to be a successful independent contractor. But before we highlight these steps, let’s first understand what an independent contractor is advantages and disadvantages of independent contracting.

What is an Independent Contractor?

Independent contractors are businesses or people working or providing services to other people or businesses as non-employee. Independent contractors are also known as freelancers, free agents, or consultants.

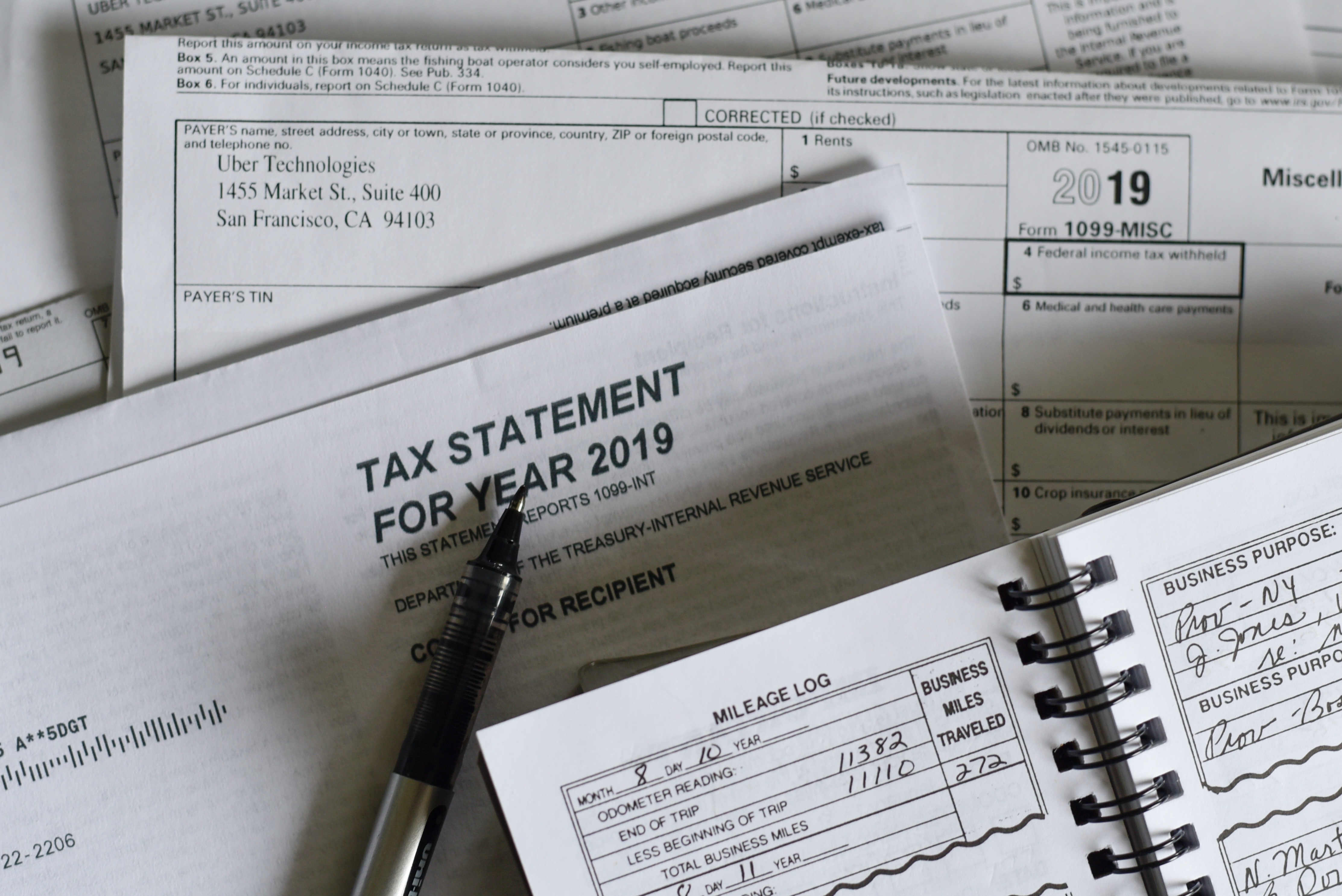

Essentially, independent contractor handles most task by themselves, for example, paying self-employment tax from their income instead of a business where employees get their taxes deducted from their paycheck.

Contractors play a huge role in the business landscape, which is appealing to many people. And so, what are the advantage and disadvantages of independent contracting?

Advantages of Independent Contracting

If you’re looking to become a freelancer, here are some of the key benefits of becoming an independent contractor:

- You become your own boss

- You have the freedom to choose your best time and place to work

- Freelancing allows you to decide how to work to ensure quality deliverables within the given time frame

- Freedom to work on your own under no supervision

- Higher potential to make more money than regular employees

- Ability to collaborate and work with your client’s employees

- Ability to pay less in taxes by utilizing permissible business deductions to reduce your taxable income

Now that you know the benefits of independent contracting, What are its downsides? Let’s see!

Disadvantages of Independent Contracting

Yes, being an independent contractor has lots of it benefits; however, working on your own and not being employed feature some setbacks, such as:

- You won’t be able to enjoy employer benefits such as retirement benefits, paid leave, medical coverage, and many other bonuses

- Freelancers rely on their clients to get paid, unlike regular employees who are guaranteed to get paid by the end month

- There are fewer labor laws to protect freelancers

- No compensation in case of any work-related injuries

- As an independent contractor, you will likely pay more for medical insurance.

- You are solely responsible as a freelancer for any business liabilities

- Sometimes a client might take a long time to pay, or they might not pay you at all

Independent Contractor Job Requirements

You need the following to be successful as an independent contractor:

- Being able to work hard and efficiently without supervision

- Enough experience in that field to show that you can deliver on the contracted job

- A portfolio demonstrating your previous work and achievements

- Strong self-motivation to push you into accomplishing all your tasks

- Relevant certifications, i.e., a bachelor’s degree

- Exceptional problem-solving and analytical skills to show you can recognize and resolve any problem that might occur

- Ability to get everything needed to complete the contracted job, for example, human resources and materials

Now that you know the benefits, setbacks, and requirements of freelancing, here is how to become an independent contractor.

How to Get an Independent Contractor License

The process of getting licenses vary from one state to another; in some state, you may need federal and local licenses, while in others, you will need one of these two.

You must also note that business licenses vary depending on the type of business structure, location, and industry you choose. So, basically, you need to find out what the requirements are before applying for licensing.

Now to answer your question, ‘How do I become an independent contractor?’ follow the steps below.

5 Steps: How to Become an Independent Contractor

Step 1: Determine Your Business Structure

To become an independent contractor or create a contracting firm, you must start by identifying a suitable business structure. For this, you can choose either a limited liability company, partnership, or sole proprietorship. Remember, to keep an eye on important factors such as Type of industry, Future operations, and Costs of set-up.

The type of industry is essential since almost every company has a preferred type of contractor they would like to work with. So, find out which structure your potential companies like working with.

Cost is another variable that needs to be factored in because all structures don’t cost the same to set up. So, find out more about the costs of set-up your likely structure. Finally, keep in mind your future operation that might involve working in different provinces.

Step 3: Choose a name for your independent contracting business

Name is an essential part of every business as it helps with things such as, branding and more. Therefore, ensure that you choose the name that well describes your business.

After choosing a suitable name, register your business name before moving to the next step.

Step 3: Get proper licensing, permits, and insurance for your business

To operate any business, including independent contracting, you must get permits and licenses. Without these two, you will risk getting fined or even receiving an order to cease your operation. Basically, it can get you in trouble. You might need several permits to start your operation, for example, federal and provincial permits, such as health and environmental permits.

Insurance is another important thing to have for a contracting business. It helps you cover and mitigate the losses without having to incur big fees.

Step 4: Find your business taxation requirements and business number

A business number and tax reporting regulations are two other important factors to consider when setting up a contracting business. So, it is advisable that you find the tax requirement, regulations within your business locations, and regulations that fit your type of business.

Since you will be a sole proprietor, your tax bracket for your business income will be under personal income tax returns.

Step 5: Develop workplace rules and safety requirements

Before kickstarting your business, ensure that you have well-established requirements for your workplace safety ready. This is important as it will help protect your and your employees from potential injuries, and more importantly, it will protect your business from unnecessary losses that could have been avoided.

Safety policies are one of the key legislative requirements for any business to be granted a permit to work.

Conclusions

Overall, it is not a complex process to become an independent contractor. All you need to do is follow the above steps on how to be an independent contractor, and you’re fine.

On top of learning how to start an independent contractor business, you need to know how to create a contracting document to help ease your contracting process. A well-defined document like this independent contractor agreement template is essential in ensuring all important things are factored in.

Join the conversation!