Twenty states across the nation are taking unusual steps to punish people who default on student loans.

Sky-high tuition, limited opportunities for financial aid, and an uncertain job market have led ever-growing numbers of Americans to enroll in college classes. Some start young, while others return to university past their thirties or forties.

Yet few, in today’s economic climate, can afford an education by paying out-of-pocket.

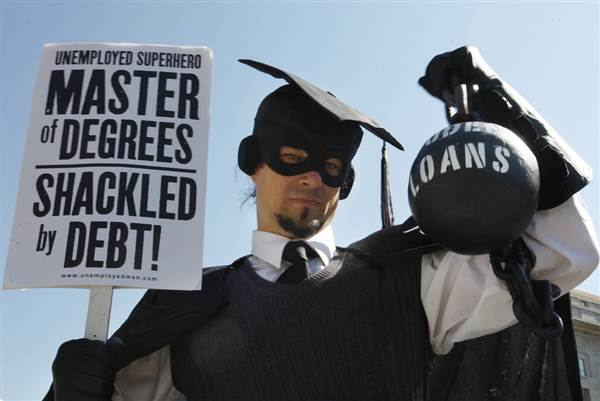

As undergraduate degrees take the place of high school diplomas on employment applications, many have resorted to borrowing money they don’t have in the bank.

And the dynamics of today’s workforce are apparent – seven years ago, student loans surpassed credit cards as the leading cause of debt in the United States. According to Forbes.com, some 44 million borrowers owe $1.3 trillion in total.

In response to the ever-growing balloon of student loan debt, states have started clamping down.

Now, borrowers who thought an education might enhance career prospects could find themselves out of a job.

Nineteen states around the nation have implemented policies that’d strip professional licenses from debtors who can’t make regular payments. And in South Dakota, driving privileges can be revoked, too.

Firefighters, physicians, lawyers, and therapists have all had their credentials either suspended or canceled for failing to make timely payments on student loans. Public records requests made by The New York Times estimates at least 8,700 Americans have run afoul of new state regulations aimed at punishing people who only tried to help themselves succeed.

Tennessee, the Times reports, is among the most aggressive states in pursuing purported late-payers.

Between 2012 and 2017, ‘officials reported more than 5,400 people to professional licensing agencies.’ One woman interviewed by the paper lost her career, while others were temporarily or permanently stripped of their credentials.

“It’s like shooting yourself in the foot,” said Daniel Zolnikov, a Republican state representative from Montana.

Since those who default on loans are already punished with “credit scores dropping, being traced by collections agencies, just having liens,” it makes little sense for states to get too involved, says Zolnikov.

“The free market has a solution to this already. What is the state doing this hammer?” he asked.

South Dakota started revoking driver’s licenses in 2015, to prompt repayment from debtors who owe the state.

“It’s been quite successful,” said Nathan Sanderson, policy director for Governor Dennis Daugaard.

One county commissioner, Jeff Barth, disagrees. Calling the laws short-signed, he thinks it’s “better to have people gainfully employed.”

Sparsely-populated South Dakota has few major cities and a scarcity of public transportation options. One person losing the ability to drive can, effectively, run a family’s livelihood into the ground.

“I don’t like people skipping out on their debts,” said Barth, “but the state is taking a pound of flesh.”

Sources

College Degree: Not What It Used To Be

Student Loan Debt In 2017: A $1.3 Trillion Crisis

Join the conversation!