California’s new debt settlement laws, notably the FDSPA, signify a pivotal stride towards shielding consumers from predatory practices, ensuring fairness, transparency, and informed decision-making.

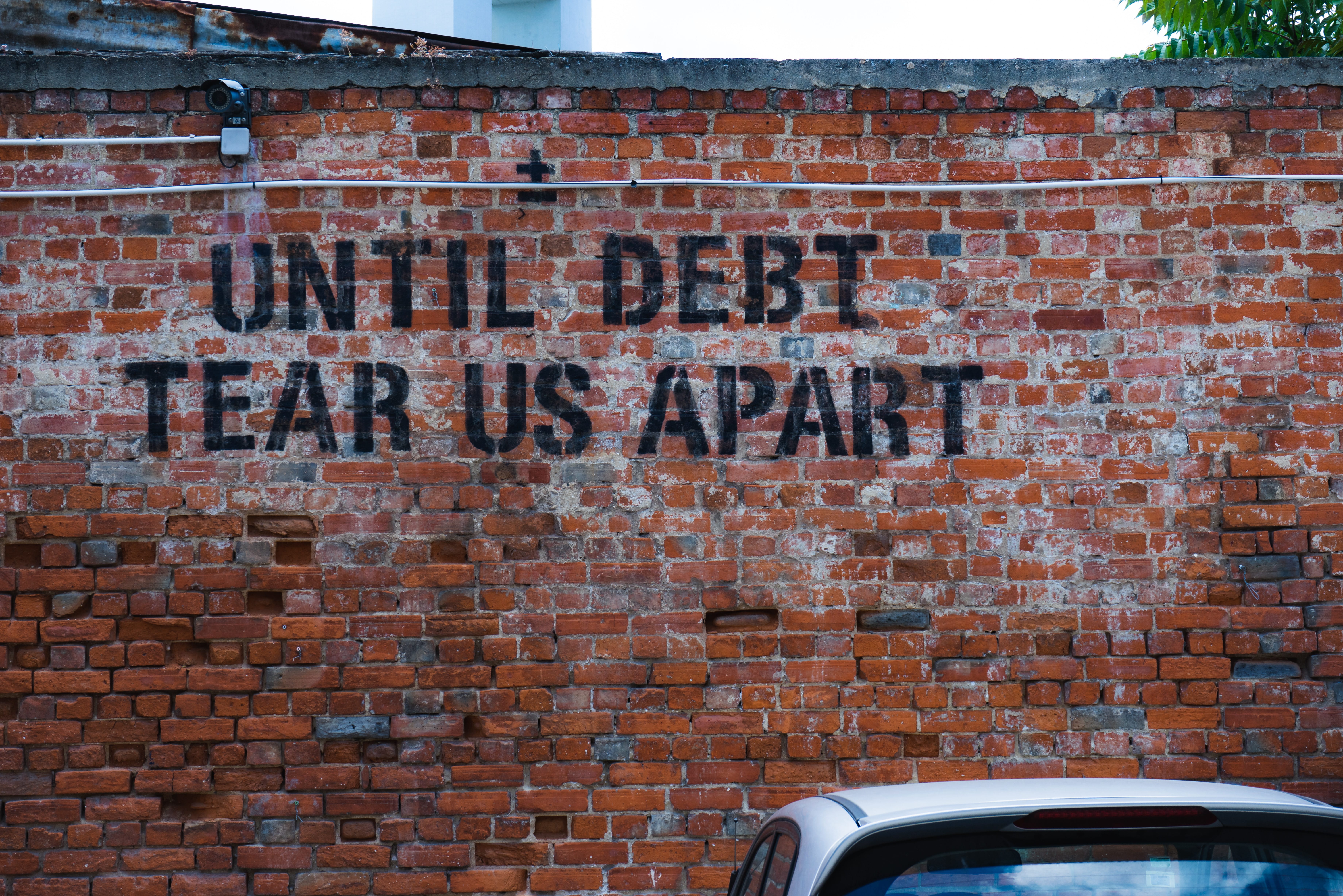

In an increasingly difficult economy, the burden of debt has become an overwhelming reality for many individuals and families. Debt settlement stands as a beacon of hope for many consumers who are grappling with unsurmountable debts, offering a potential pathway to regain control over their finances. Recently California took a momentous stride in safeguarding the interests of its residents by enacting the Fair Debt Settlement Practices Act (FDSPA), a groundbreaking set of laws designed to regulate and monitor the practices of debt settlement providers. By establishing strict guidelines, the FDSPA aims to curb unfair and deceptive practices employed by certain companies, ensuring greater transparency, fairness, and security for individuals who are seeking relief from their financial obligations.

A Brief History of California’s Debt Settlement Regulations

California has long been at the forefront of enacting consumer protection laws, particularly in the realm of debt settlement regulations in addition to the existing federal regulations. Historically, the state has exhibited a commitment to safeguarding its residents from predatory practices. The landscape of debt settlement regulations in California has evolved over the years. Initial efforts primarily relied on existing consumer protection statutes and general business regulations to address deceptive practices within the debt settlement industry. However, the complexity and nuances of debt settlement transactions prompted California policymakers to call for more targeted and stringent regulations.

Existing federal regulations, such as the Federal Trade Commission’s rules, offered some safeguards for consumers dealing with debt settlement companies. While the FTC rules outline specific practices that debt settlement companies must follow, enforcement of these rules proved to be a challenge. Additionally, federal regulations did not always adequately address state-specific concerns or quickly adapt to the dynamic nature of the debt settlement landscape.

The need for state-level regulations became increasingly apparent to bridge the gaps left by federal mandates. California recognized the necessity to bolster consumer protection measures by implementing state-specific laws tailored to address the unique challenges faced by its residents. Unlike federal regulations, state-level regulations could offer a more nuanced and targeted approach. They also complement federal guidelines and fill crucial voids in consumer protection, ensuring a more comprehensive framework for individuals seeking debt relief.

Key Provisions of the Fair Debt Settlement Practices Act

The Fair Debt Settlement Practices Act (FDSPA) in California serves as a pivotal shield against exploitative practices within the debt settlement industry. Here are its key provisions:

- Prohibition of False, Deceptive, or Misleading Practices: The FDSPA explicitly prohibits debt settlement companies from engaging in any deceptive, false, or misleading acts or practices. This includes misrepresenting services, outcomes, or terms to consumers. It aims to ensure transparency and honesty in all dealings between these companies and individuals seeking debt relief.

- Detailed Disclosures and Contract Information: Debt settlement providers are mandated by the FDSPA to furnish consumers with comprehensive and detailed disclosures regarding their services, fees, the duration of the program, potential outcomes, and risks involved. This requirement aims to empower consumers with vital information needed to make informed decisions about their financial situations.

- No Fees Until There is a Settlement and Payment: There can be no fees assessed whatsoever until and unless there is a written settlement agreement AND a payment on the settlement is made by the consumer. This is huge for consumers who in the past paid fees and never got the settlement promised. This only put them further into debt. Now the provider must perform or they will not get paid.

- Three-Day Cooling-off Period: The FDSPA establishes a crucial three-day waiting period for consumers before signing a debt settlement services agreement. During this time, consumers have the right to reconsider the terms and ramifications of the agreement without any obligation. This period allows individuals to assess the terms thoroughly before committing to the settlement.

- Private Right of Action for Consumers: Importantly, the FDSPA grants consumers the right to take legal action against debt settlement companies that violate the provisions outlined in the act. This private right of action empowers individuals to seek legal remedies, including damages, if they have been harmed by the deceptive or unfair practices of these companies.

Overall, the FDSPA in California stands as a robust framework aimed at ensuring fair and ethical practices within the debt settlement industry. By outlining clear guidelines, enforcing transparency, and providing avenues for legal recourse, the act bolsters consumer protection and strives to create a more equitable landscape for individuals seeking relief from overwhelming debts.

Benefits of California’s New Debt Settlement Laws

As a lawyer who specializes in consumer protection, I welcome California’s implementation of these consumer debt settlement laws. These legislative strides are pivotal in safeguarding consumers from predatory practices that are rampant in the debt settlement industry.

One of the aspects of the FDSPA is its stringent regulations aimed at curbing unscrupulous practices. It acts as a shield against the exploitation of vulnerable consumers by mandating that debt settlement companies adhere to transparent and fair practices. This transparency empowers consumers, giving them the ability to make informed decisions about their financial future without falling prey to misleading or incomplete details given by predatory lenders.

The introduction of the waiting period grants consumers the invaluable opportunity to meticulously evaluate debt settlement agreements before accepting them. It allows consumers a crucial timeframe to weigh their options, seek out advice, and fully comprehend the potential consequences of the proposed settlement. This grants the consumer an informed decision-making process. Equally important is the provision granting consumers a private right of action. This instills accountability within the debt settlement industry, knowing that consumers have the right to legal recourse should they fall victim to unfair treatment or malpractice by debt settlement entities.

Recommendations for Consumers Considering Debt Settlement

As a debt protection attorney, I have witnessed firsthand the struggles of individuals grappling with overwhelming debt. It is crucial to approach debt settlement with knowledgeable support and make informed decisions to avoid falling prey to scams or making choices that could further jeopardize your financial well-being.

For consumers who are facing mounting interest charges and potential legal action, debt settlement can offer a way to settle their debts for less than the full amount owed, providing some relief from the burden of debt. However, it is essential to recognize that debt settlement has its drawbacks. The process can be lengthy, often taking several years to complete, and it will negatively impact your credit score.

If you decide to pursue debt settlement, compare different debt settlement providers, evaluate their track records, and scrutinize their contracts for any hidden terms or conditions. Most importantly, consult with a lawyer or trusted financial advisor to assess your specific circumstances and determine if debt settlement aligns with your long-term financial goals.

Seek Professional Assistance

California’s new debt settlement laws, notably the FDSPA, signify a pivotal stride towards shielding consumers from predatory practices, ensuring fairness, transparency, and informed decision-making. By arming themselves with knowledge about their rights, consumers can actively safeguard themselves against potential exploitation and make informed choices that best meet their needs.

For those seeking further guidance regarding debt settlement, there are numerous resources available. Initiatives such as the California Department of Financial Protection and Innovation (DFPI) offer valuable information and guidance to consumers. Legal aid organizations and consumer advocacy groups also provide support and additional resources for consumers looking for trustworthy and reputable sources. Empowerment through knowledge remains the key to navigating the complexities of debt settlement and securing a more secure financial future.

Join the conversation!