Some people who owe money to the IRS may end up in a situation where the government takes away their money and other kinds of property.

Baltimore, MD – Taxes need to be paid to the government by every person or business that has income. The government takes this obligation seriously, and the IRS has a number of things that they can do to investigate tax issues and enforce the relevant tax laws. Lawyers can provide tax advice about various issues that can get someone in trouble with the IRS, although it is best for any individual to try to get assistance from a tax professional before they run into trouble. Here are some of the enforcement measures used by the government.

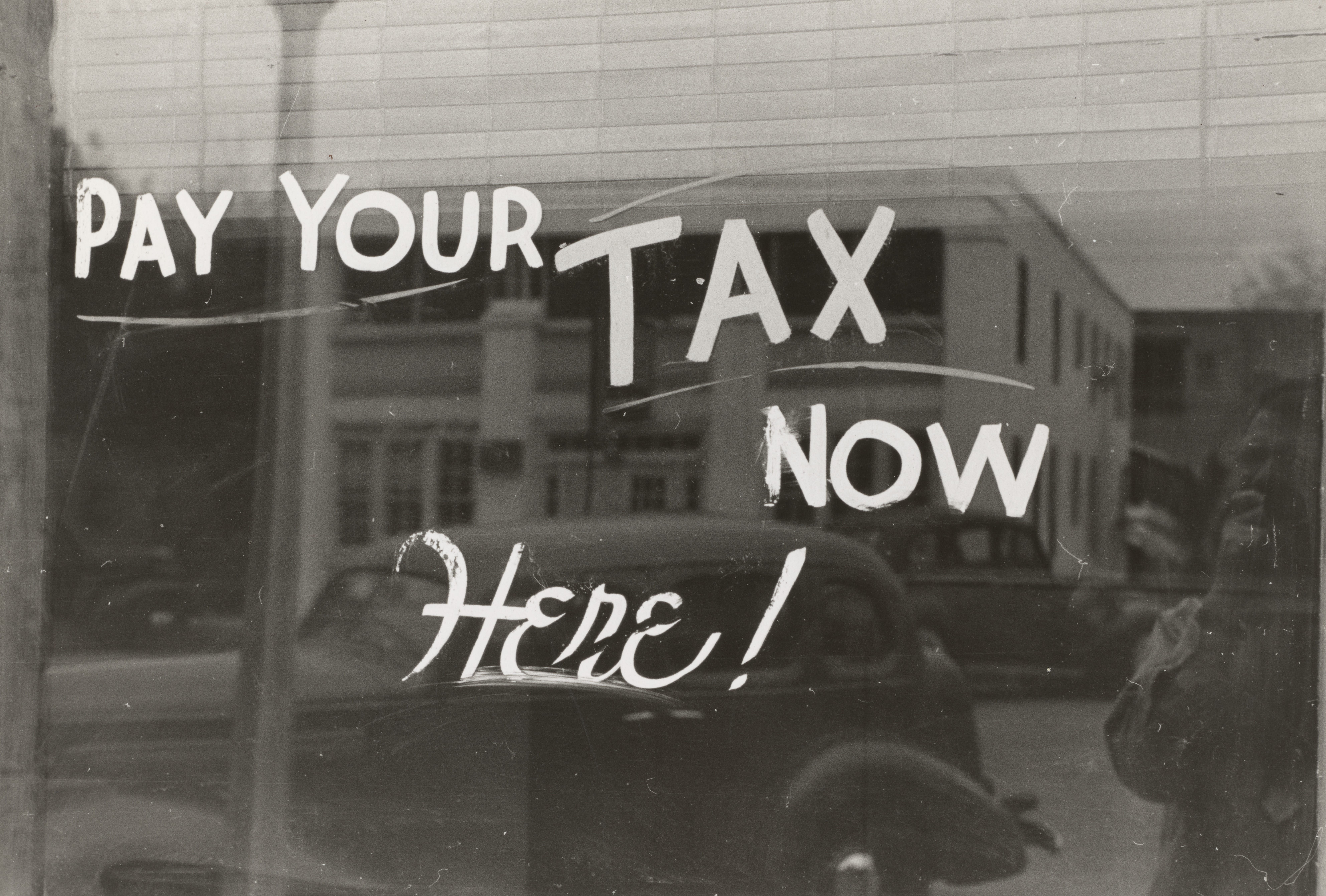

Making the person pay the taxes they owe

It is fairly common for the IRS to give a person a tax bill and tell them it needs to be paid or settled. This is generally not a big deal, however people who have outstanding tax debt should be aware that they can end up with additional fees and interest on unpaid taxes if they wait too long. Baltimore tax lawyers routinely help people negotiate and settle debt to the IRS, and they may even save money in the process if they get legal advice at this time. It is better to clear up any issues related to unpaid taxes quickly before the government has to use other means to try to get what is owed to them.

Criminal charges

The government has the authority to prosecute people who commit serious offenses related to their taxes. While people who make simple or honest mistakes on their taxes generally do not have to worry about prosecution, it is possible that people who are intentionally trying to avoid their tax liability or lie about excessive deductions, donations, or expenses can land in jail. Maryland tax lawyers can help people with serious tax issues avoid criminal prosecution or resolve a pending case. As a general rule, the government mostly prosecutes people who are clearly committing fraud and avoiding the payment of large sums of money.

Property seizures

Some people who owe money to the IRS may end up in a situation where the government takes away their money and other kinds of property. The things that the IRS seizes to get paid correctly include bank accounts, motor vehicles, boats, real estate, and tax refunds. The government will normally avoid taking these actions while a person is attempting to communicate with the IRS and solve their tax issues, however tax lawyers should certainly be contacted for assistance if the government is already in the process of taking property. Estate planning lawyers can also help manage any issues related to real property or trust funds that are going to be used as part of an estate or a trust that gradually pays out money to a person or charitable cause.

Legal advice about taxes

USAttorneys.com is a service that can refer people to lawyers in any practice area in their location. Those who need assistance can call 800-672-3103 to get connected.

Join the conversation!