If a debt collector violates your rights, report the incident to the Consumer Financial Protection Bureau (CFPB) or seek legal advice to protect your interests and pursue recourse.

Understanding the laws that protect you from unfair debt collection practices is crucial. Familiarizing yourself with these regulations safeguards your finances and ensures fair treatment by debt collectors.

In this blog post, we’ll explore the importance of debt collection laws, key provisions of the Fair Debt Collection Practices Act (FDCPA), and how you can effectively navigate the world of debt collection.

The Importance of Debt Collection Laws

Debt collection laws are designed to protect your interests. They serve several essential functions:

Safeguards Against Abusive Practices: These laws protect you from harassment, threats, and deceptive tactics used by some debt collectors. You have the right to be treated with respect and dignity throughout the debt collection process.

Ensuring Fair Treatment for Consumers: By establishing clear guidelines for debt collectors, these laws help ensure that you’re not subjected to unfair or misleading practices. You can feel confident knowing that there are legal protections in place to safeguard your rights.

Enhancing Financial Stability and Security: Knowing your rights under debt collection laws helps you make informed decisions and maintain control over your financial well-being. You can take steps to resolve debts and prevent further financial strain.

Ultimately, understanding and utilizing the protections offered by debt collection laws not only preserves your financial health but also contributes to a fairer and more equitable financial system. It encourages a balanced approach where both creditors and debtors can resolve their disputes in a manner that upholds dignity and respect for all parties involved.

In New Jersey, residents frequently encounter aggressive collection tactics and high levels of consumer debt, which can overshadow their financial stability. These issues are particularly prevalent in urban areas where economic disparities are more pronounced. The concept of New Jersey debt relief has proven effective in addressing these specific financial strains, offering residents a viable path to regaining control over their finances and ensuring their rights are protected under the law.

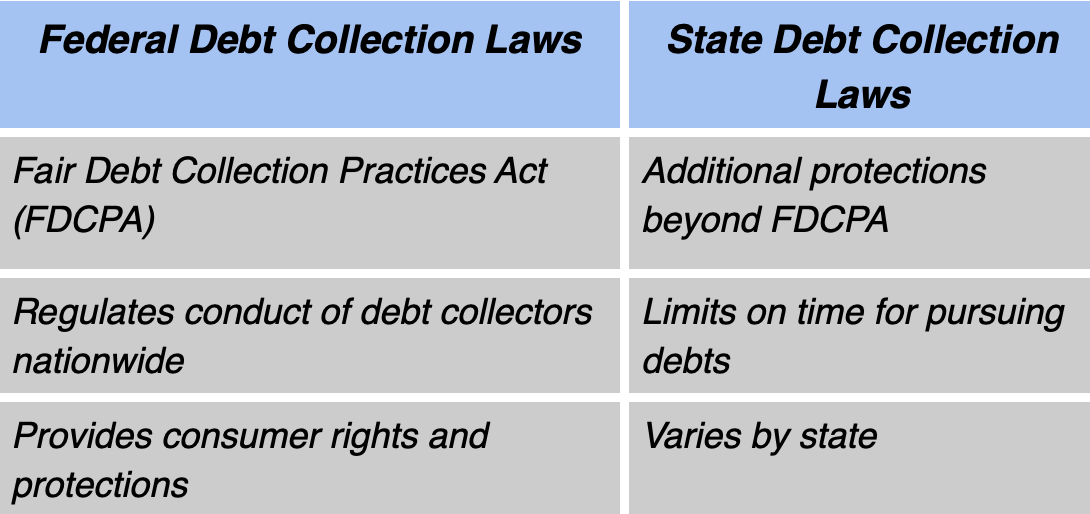

Key Provisions of the Fair Debt Collection Practices Act (FDCPA)

The FDCPA is a federal law regulating the conduct of debt collectors. Key provisions you should be aware of include:

Regulation Overview: This update to the FDCPA, effective November 30, 2021, clarifies and modernizes the rules for debt collection communications. It provides you with greater transparency and control over how debt collectors can contact you.

Communication Guidelines for Debt Collectors: The FDCPA sets strict limits on when, where, and how often debt collectors can contact you. They cannot call you before 8 a.m. or after 9 p.m., and they must respect your request to stop contacting you.

Prohibited Conduct by Debt Collectors: Debt collectors are prohibited from using abusive language, making false threats, or engaging in unfair practices like contacting your employer or family members. If you experience these behaviors, you have the right to take action.

Rights and Protections for Consumers

Under the FDCPA, you have several important rights that empower you when dealing with debt collectors:

Right to Dispute Debts: If you believe a debt is incorrect or not yours, you have the right to dispute it and request verification from the debt collector. This puts the burden of proof on the collector to substantiate the debt.

Validation and Verification of Debt: Debt collectors must provide written validation of the debt within five days of initial contact. This information should include the amount owed, the creditor’s name, and instructions on how to dispute the debt.

Protections Against Harassment and Abuse: You can demand that debt collectors stop contacting you, and they must comply. If you feel harassed or abused by a debt collector, you can take legal action to protect yourself.

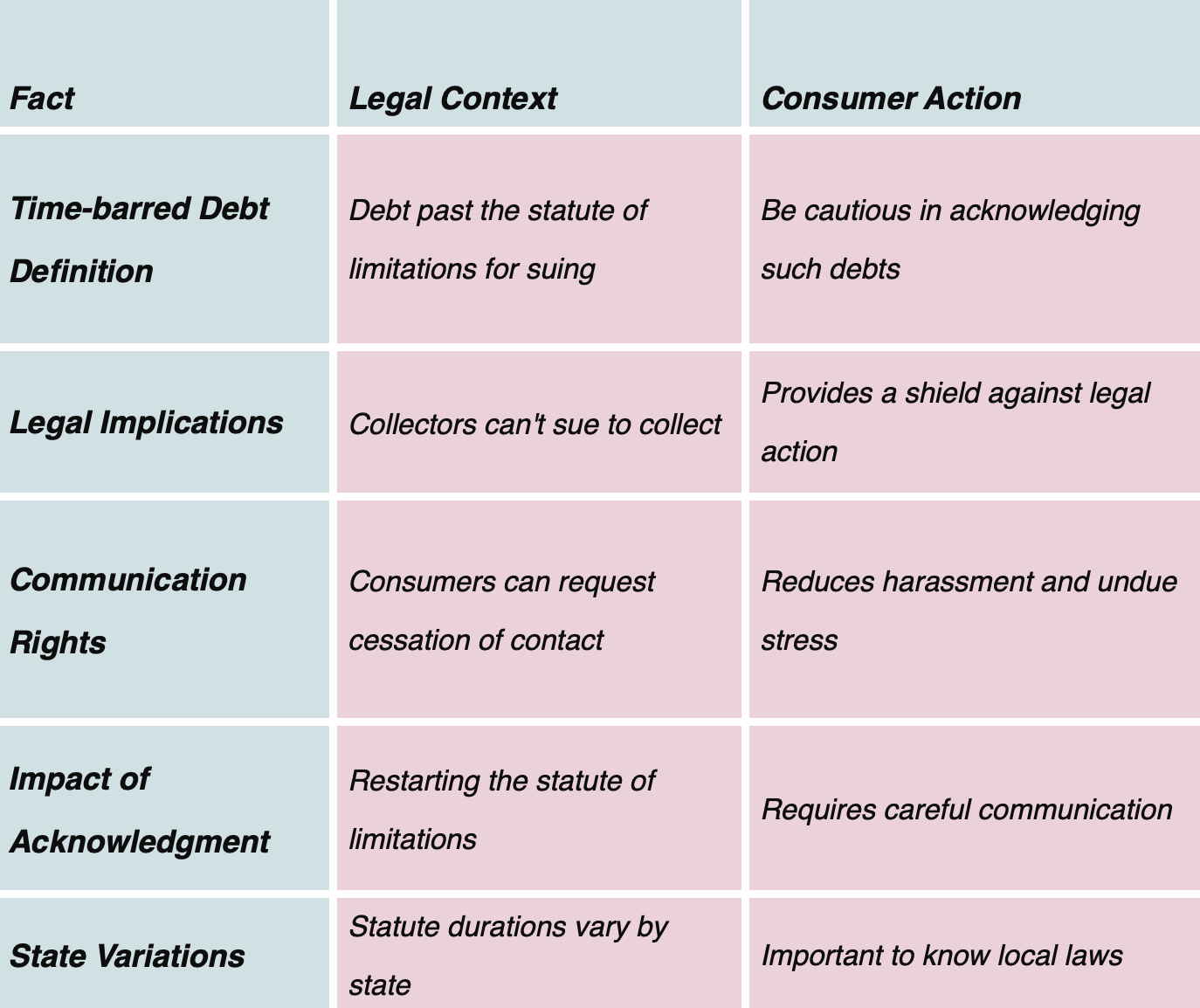

Understanding Time-Barred Debts

Time-barred debts have exceeded the statute of limitations for collection. Once a debt is time-barred, debt collectors can’t sue you to collect it, but they may still contact you. You have the right to request that they stop communication.

In some states, acknowledging a time-barred debt can restart the statute of limitations, so be cautious when communicating with debt collectors about old debts. If contacted about a time-barred debt, you can request the collector cease communication or seek legal advice to understand your options.

Debt Collection Laws and Credit Reports

Debt collection activities can significantly impact your credit score. Delinquent debts and collection accounts can damage your credit score, but understanding your rights and resolving debts can minimize the negative impact.

Debt collectors must follow rules when reporting debts to credit bureaus and can’t report inaccurate information. If you find errors on your credit report related to debt collection, you can dispute and correct them.

State-Specific Debt Collection Laws

In addition to federal regulations, many states have their own debt collection laws that provide additional consumer protections. Some states limit the time debt collectors can pursue debts or restrict wage garnishment.

Understanding how state laws interact with federal regulations is important, as state laws may provide stronger protections. Familiarize yourself with your state’s debt collection laws to better protect your rights.

How to Respond to Debt Collectors

When dealing with debt collectors, communicate effectively and assert your rights. Be clear, concise, and firm in your interactions with debt collectors. Keep detailed records of all communications, including dates, times, and the content of the conversations.

Always request written validation of debts and keep copies of all correspondence. This documentation is invaluable if you need to dispute a debt or take legal action.

If you feel your rights have been violated or you need help navigating the debt collection process, don’t hesitate to seek legal advice. Many consumer protection attorneys offer free consultations and can guide you through your options.

The Role of Regulatory Bodies

Several regulatory bodies oversee debt collection practices and provide resources for consumers. The CFPB offers resources and guidelines for consumers dealing with debt collection issues.

The website offers educational materials, sample letters, and instructions on how to file complaints. The CFPB and other agencies, such as the Federal Trade Commission (FTC), enforce debt collection laws and take action against violators.

They investigate consumer complaints and can impose penalties on debt collectors who violate the law. These agencies offer educational materials and support services to help you understand your rights and navigate the debt collection process. Utilize these resources to empower yourself and protect your finances.

Preventive Measures for Financial Protection

While understanding debt collection laws is essential, taking proactive steps to manage your finances can help you avoid debt collection issues altogether:

- Budgeting and Financial Planning Tips: Create a budget, track your expenses, and prioritize saving to build a solid financial foundation. By living within your means and setting aside money for emergencies, you can reduce the likelihood of falling into debt.

- Avoiding Common Debt Traps: Be cautious when using credit cards, taking out loans, or agreeing to payment plans. Understand the terms and conditions of any debt you incur, and avoid taking on more debt than you can reasonably afford to repay.

- Building and Maintaining Good Credit: Pay your bills on time, keep your credit utilization low, and regularly monitor your credit reports to maintain a healthy credit profile. Maintaining good credit opens doors to better financial opportunities and helps you avoid high-interest debt.

Understanding debt collection laws and proactively managing your finances protects you from unfair debt collection practices and helps you maintain control over your financial well-being. Remember, knowledge is power when navigating the world of debt collection. Stay informed, know your rights, and seek help when needed.

Key Takeaways:

- Familiarize yourself with the Fair Debt Collection Practices Act (FDCPA) and your state’s debt collection laws to understand your rights as a consumer.

- Know that you have the right to dispute debts, request validation, and stop communication from debt collectors.

- Keep detailed records of all communications with debt collectors and request written documentation of debts.

- Seek legal assistance if you believe your rights have been violated or you need help navigating the debt collection process.

- Take proactive steps to manage your finances, such as budgeting, avoiding debt traps, and maintaining good credit to minimize the risk of dealing with debt collectors.

By following these guidelines and staying informed about debt collection laws, you can protect your finances and ensure fair treatment throughout the debt collection process. Remember, you have rights and protections under the law, and there are resources available to help you navigate this complex landscape. Stay empowered and take control of your financial future.

FAQs

- What are the key benefits of understanding debt collection laws?

Understanding debt collection laws helps you avoid unfair practices, ensuring your financial dealings are secure and respected.

- How can the Fair Debt Collection Practices Act (FDCPA) safeguard my financial well-being?

The FDCPA regulates debt collector behavior, preventing harassment and ensuring adherence to ethical collection practices.

- What should I do if a debt collector violates my rights under debt collection laws?

If a debt collector violates your rights, report the incident to the Consumer Financial Protection Bureau (CFPB) or seek legal advice to protect your interests and pursue recourse.

Join the conversation!