Depending upon the category of a hurricane, and dangers to Florida residents and property, Category 3 or above hurricanes require mandatory evacuation to ensure safety.

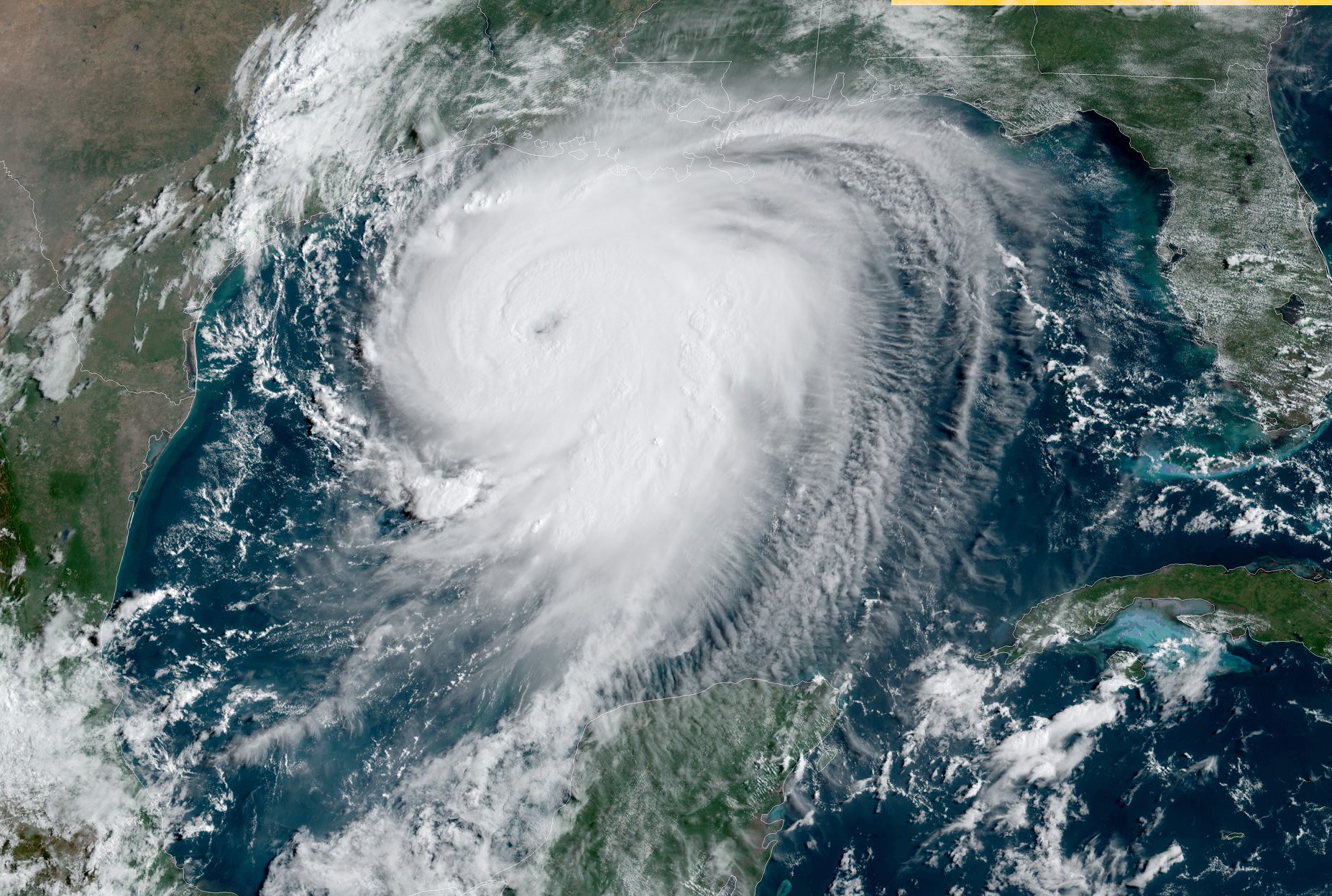

Florida hurricanes are not the only concern for home and property owners in the Sunshine State. Other hazards may be related storm surges, heaving flooding, destructive winds, tornadoes, high surf and rip currents, and tropical cyclones. The National Oceanic and Atmospheric Administration (NOAA) has forecasted an approximate range of 14 to 21 named storms (winds of 39 mph or higher), of which 6 to 10 could become hurricanes (winds of 74 mph or higher), including 3 to 6 major hurricanes (category 3, 4 or 5; with winds of 111 mph or higher). NOAA provides these ranges with a 70% confidence level. Florida residents who have sustained property damage and are having issues with claims submission and payment should contact Florida insurance lawyers at the Shochet Law Group for assistance.

Common dangers may cause property ruin

- Flooding from heavy rain may cause fatalities from landfalling tropical cyclones with widespread torrential rain that can cause flooding persisting for several days.

- Winds from a hurricane can damage and destroy signs roofing materials, sheds, patios, outdoor fixtures and if detached could cause damage of impalement due to winds propelling them into makeshift flying missiles.

- Tornadoes accompany land falling tropical cyclones and occur in rain bands away from the center of a storm.

Mandatory evacuation

Depending upon the category of a hurricane, and dangers to Florida residents and property, Category 3 or above hurricanes require mandatory evacuation to ensure safety. Forced evacuations cause homeowners to incur expense to secure properties in their absence and pay for other costs including food, gas, and temporary lodging if they must ride out a storm at another location. Some Florida homeowner’s insurance policies cover these costs, but it is wise to talk with your insurance agent to make certain there are no serious issues as a storm approaches. Experienced insurance claims lawyers will conduct policy reviews to make sure documents have appropriate loss of use coverages and assist with claims that are submitted after a storm.

Loss of use coverages

Most homeowners’ insurance policies include loss of use coverages that may address:

- Additional living expenses coverage (ALE insurance): ALE insurance reimburses homeowners for additional living expenses resulting from having to live away from home after a covered loss.

- Fair rental value: As a homeowner renting out a property, fair rental value, also known as loss of rent insurance, reimburses for lost rental income when renting a home and it becomes uninhabitable due to a covered loss.

Prohibited use coverages

Prohibited use is included under loss of use coverage. Prohibited use applies when a governmental authority prohibits residents from accessing their undamaged homes. Even when a home was not damaged, owners can file a loss of use claim for additional living expenses without damage, because they are restricted from going home. Coverage could also include meals and incidental expenses. This coverage is like but slightly different from the coverage that kicks in when a home becomes uninhabitable. That coverage is called loss of use coverage, and details will vary depending on the policy and the company issuing it.

Seek legal counsel

Florida property owners who find themselves involved with insurance disputes arising out of claims for loss of use, or prohibited use of a home when a hurricane threatens Florida should contact the Shochet Law Group who can help file, or dispute an insurance claim rejection.

Sources:

Join the conversation!