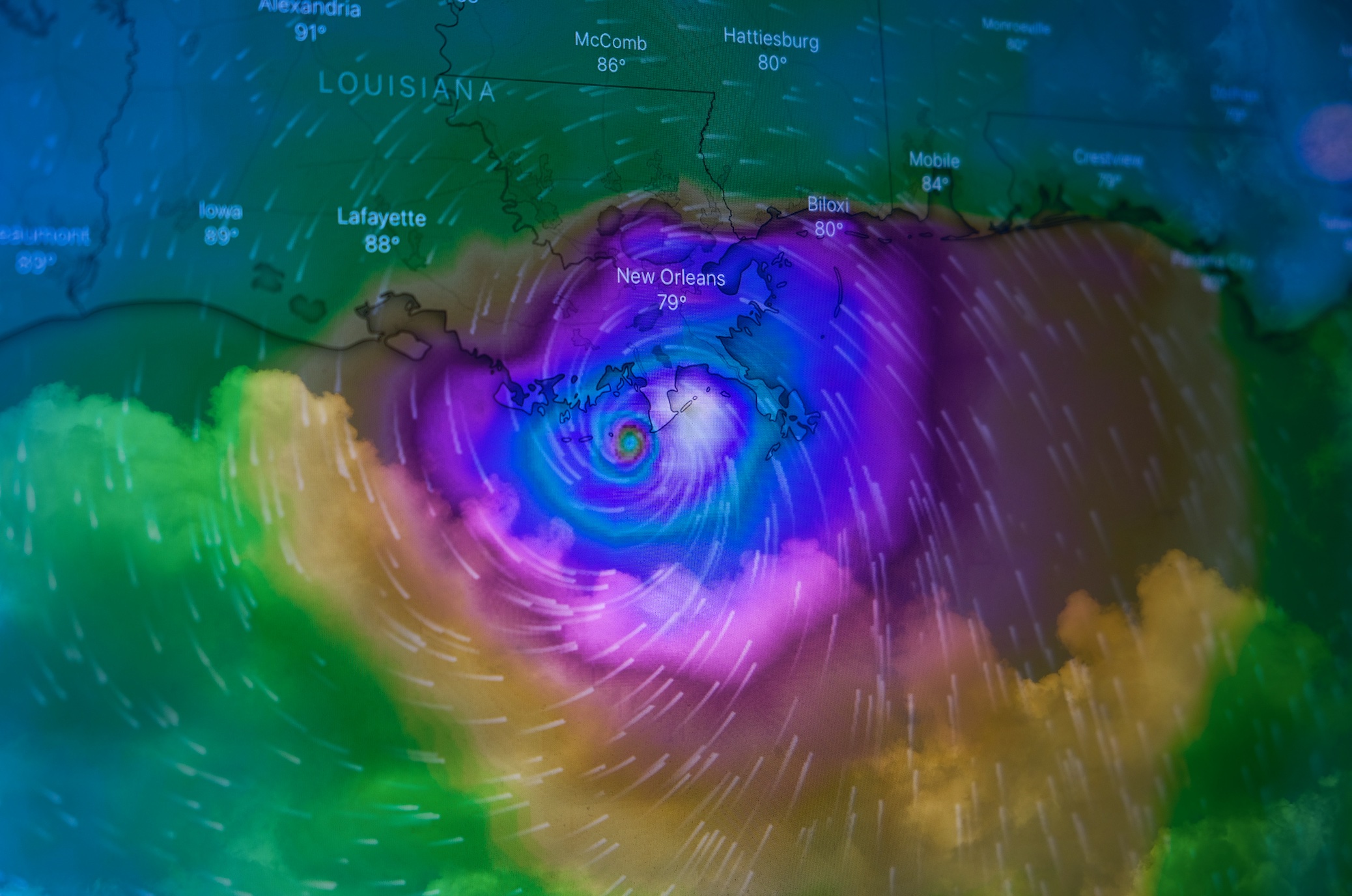

If you have suffered flood damage to Hurricane Ida, your situation could get a little more complicated.

If you’ve suffered considerable damage to your property, you might be wondering whether your homeowners’ insurance policy provides you with adequate coverage. This is a common question for those living in Metairie, as residents have been forced to deal with the havoc caused by Hurricane Ida. Unfortunately, numerous homeowners are having trouble finding answers, and many are still without the necessary compensation to repair, rebuild, and continue with their lives.

If you feel like you’re not making any progress as you try to receive a settlement for hurricane damage, it might be time to enlist the help of a qualified attorney. There are legal professionals in Louisiana who have plenty of experience with denied insurance claims, and they can help you push back against the insurance companies in an effective, confident manner. You deserve fair compensation for the damage you have suffered, and these lawyers can help you get it.

Your Insurance Should Cover Hurricane Damage

Generally speaking, hurricane damage is covered by typical homeowners’ insurance policies. This is because private policies generally include comprehensive coverage for wind damage, and hurricane damage is of course an example of wind damage. If your home has been damaged due to wind damage alone, you should receive full coverage from your insurance provider1.

What About Flood Damage?

If you have suffered flood damage to Hurricane Ida, your situation could get a little more complicated. Generally speaking, flood damage is a sticking point for many insurers, and it might not be covered by a typical policy. If you want coverage, you have to purchase additional coverage via the National Flood Insurance Program (NFIP). The good news is that the majority of the flood damage caused by Ida will be covered by this federal program.

Hurricane Ida Victims Still Face Challenges

Despite the fact that victims of Hurricane Ida will theoretically enjoy coverage under their homeowners’ insurance policy and the NFIP, they still face considerable challenges. Many individuals who have suffered legitimate hurricane damage have had their claims denied. In addition, homeowners must file proof of loss for damage due to Hurricane Ida by February 25th, 2022. According to Louisiana’s Insurance Commissioner, they may lose the ability to receive compensation if they fail to meet this deadline2.

Where Can I Find an Insurance Claims Attorney Near Me?

If you’ve been searching the Metairie area for a qualified attorney who has experience with denied insurance claims, look no further than Houghtaling Law Firm, LLC. Over the years, we have assisted numerous plaintiffs who have been given the run-around by their insurance providers. This type of misconduct isn’t just unacceptable – it’s also illegal. We can help you push back against these insurance providers, and we’ll make sure you receive the compensation you need to repair hurricane damage. Book your consultation today.

Sources:

- https://www.inquirer.com/business/how-to-file-flood-insurance-claim-philadelphia-homeowners-policy-20210902.html#:~:text=Hurricane%20Ida’s%20%2419%20billion%20in,Consumer%20Federation%20of%20America%20said.&text=Losses%20due%20to%20flooding%20are%20not%20covered%20under%20a%20homeowner’s%20policy.

- https://www.wdsu.com/article/deadline-to-file-proof-of-loss-for-hurricane-ida-damage-approaching/38987160#

Join the conversation!