Case filings rose nearly 20% over the last decade while class-action lawsuits tripled; Fair Credit Reporting Act and Telephone Consumer Protection Act claims rose dramatically while Fair Debt Collection Practices Act and Truth in Lending Act claims fell over the last 10 years. Volkswagen paid more than $14 billion in consumer protection damages for its “clean diesel” claims.

Lex Machina, a LexisNexis company, recently released its inaugural Consumer Protection Litigation Report, the first and only report of its kind that illuminates data-driven trends and insights from more than 132,000 U.S. District Court case filings involving consumer finance abuses or unfair or deceptive trade practices. The report finds that while consumer protection cases overall have risen slightly less than 20% in the last decade, the number of consumer protection class action lawsuits tripled by the end of 2017. To request a full copy of the report, please visit http://pages.lexmachina.com/Consumer-Protection-Report_LP—Email.html

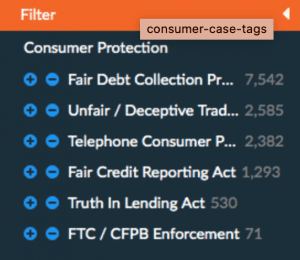

Consumer protection cases allege violations of at least one of the following federal consumer protection statutes: the Fair Debt Collection Practices Act (FDCPA), Fair Credit Reporting Act (FCRA), Truth in Lending Act (TILA), Telephone Consumer Protection Act (TCPA), or a federal consumer protection enforcement statute, such as the Federal Trade Commission Act or Consumer Financial Protection Act. Consumer finance abuse includes litigation over debt collection, credit reporting, truth in lending practices, and other related state and federal statutes. Unfair or deceptive trade practices cover federal and state statutes involving fraud, deception, abuse of consumer information, government enforcement actions, and consumer privacy.

Among the top-level findings from the report, FCRA claims increased more than 150% in the last 10 years likely due to an increased number of consumer credit report inquiries and background checks, which give rise to greater opportunity for more claims. Similarly, TCPA claims – which cover robo-calls and other text and telephone solicitations – rose more than 740% over the past decade due to increased lawsuits from the Federal Trade Commission and Consumer Financial Protection Board.

During the same period, TILA claims fell more than 800% since the 2009 mortgage crisis, possibly due to the TILA’s lower statutory damages and short statute of limitations. FDCPA claims have also slightly declined since peaking in 2011. However, FDCPA claims still make up 72% of consumer protection claims filed from 2009 through 2018.

“Litigating consumer protection lawsuits is extremely challenging due to the growing number of case filings and class action lawsuits, shifting regulations and broad judicial interpretations that can impact your case,” said Laura Hopkins, Legal Data Expert – Consumer Protection at Lex Machina. “Keeping informed on important consumer protection trends and seminal cases is paramount in order for attorneys to provide the best possible counsel and develop winning legal strategies.”

Other report highlights covering the period from 2016 through 2018 include:

- Consumer protection lawsuits were awarded more than $34 billion in damages over the last decade.

- Volkswagen paid more than $14 billion in consumer protection damages for its “clean diesel” claims.

- The largest consumer protection class action settlement awarded from 2016 to 2018 was $142 million in Jabbari et al v. Wells Fargo & Company.

- The top plaintiffs’ law firm was Atlas Consumer Law with 1,593 cases filed from 2016 to 2018, up from only five cases filed in the three-year period from 2010 to 2012.

- The most active defendants were credit reporting companies: Equifax, Experian, and TransUnion. In the three-year period from 2016 to 2018, more than 4,000 cases were filed against Equifax Information Services, LLC.

About Lex Machina

Lex Machina’s award-winning Legal Analytics® platform fundamentally changes how companies and law firms compete in the business and practice of law. The company provides strategic insights on judges, lawyers, law firms, parties, and other critical information across 15 federal practice areas and the Delaware Court of Chancery. This allows law firms and companies to predict the behaviors and outcomes that different legal strategies will produce, enabling them to close business and win cases.

Lex Machina was named “Best Legal Analytics” by readers of The Recorder in 2014, 2015 and 2016; received the “Best New Product of the Year” award in 2015 from the American Association of Law Libraries; and “Best Decision Management Solution” from AI Breakthrough in 2019. The company was named a “Legal A.I. Leader” by The National Law Journal in 2018 and was a finalist in the 2019 LegalWeek Product Innovation awards. Based in Silicon Valley, Lex Machina is part of LexisNexis, a leading global provider of legal, regulatory, and business information and analytics. For more information, please visit www.lexmachina.com.

Join the conversation!