5/11/2015

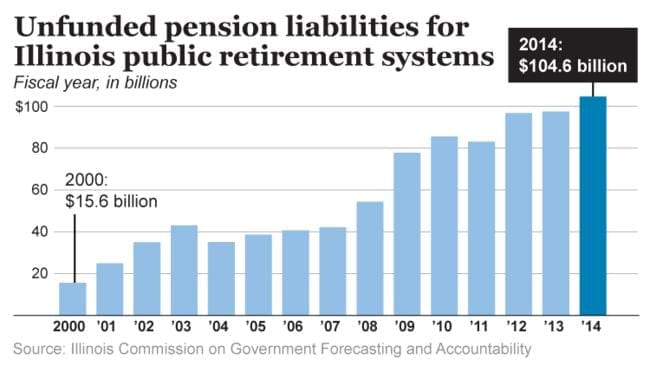

In a decision that turns a bad situation even worse for the state of Illinois, the state’s Supreme Court unanimously declared a law to reduce the amount of pension benefits for state workers to be unconstitutional. The controversial law titled SB 1, signed in December, 2013 by then-Governor; Pat Quinn, reduced compounded cost-of-living increases for retirees, as well as raised the retirement age for current state workers. The state argued that budgetary turmoil necessitated the law, and that the financial crisis required a drastic response. In the May 8th ruling, however, all 7 justices found the law to be in violation of the Pension Protection clause in the state’s 1970 Constitution. Justice Lloyd Karmeier, writing the court’s opinion, states “The law was clear that the promised benefits would therefore have to be paid and that the responsibility for providing the state’s share of the necessary funding fell squarely on the legislature’s shoulders.” The remarks are not only pointed at the law itself, but also directed towards legislators who allowed a temporary sales tax increase, enacted in 2011, to expire on January 1st of this year. Illinois faces, by far, the worst budgetary crisis of any state, with a $105 billion total public retirement debt and a $6 billion budget deficit that must be balanced before the legislature adjourns for recess on May 31st. Additionally, the ruling could spell problems for Chicago and other municipalities in the state, who are also facing similar budgetary crises.

In response to the ruling, Republican Governor Bruce Rauner, who encouraged the sunsetting of the sales tax increase, is seeking to respond to the judicial challenge by introducing a Constitutional Amendment. Rauner’s spokesman, Lance Trovar said, “What is now clear is that a Constitutional Amendment clarifying the distinction between currently earned benefits and future benefits not yet earned, which would allow the state to move forward on common-sense pension reforms, should be part of any solution.” Expert consensus is that even if an amendment is passed, it will be tied up in litigation for many years. University of Illinois Public Affairs professor, Charles N. Wheeler III, calls such a proposal “irrelevant,” and says, “My prediction, based on what the court has said so far, is the amendment wouldn’t be constitutional for those in the system. You don’t need an amendment to do whatever you want to people who aren’t in the system yet.”

Conversely, Illinois’ AFL-CIO president, Michael T. Carrigan said, “We are thankful that the Supreme Court has unanimously upheld the will of the people, overturned this unfair and unconstitutional law, and protected the hard-earned life savings of teachers, police, firefighters, nurses, caregivers and other public service workers and retirees.” Rauner had already estimated the pension law’s savings as a $2.2 billion budget-gap filler, but now it is likely the only way to eliminate the shortfall is a tax increase. “This ensures that however we resolve this, the citizens of Illinois will be paying more for less service from the state of Illinois,” says University of Illinois professor emeritus, Kent Redfield. Unlike the federal government, states are required to balance their annual budget.

The ruling may have far-reaching consequences outside of Springfield. Most apparently, is the crisis for the city of Chicago, where Mayor Rahm Emmanuel has also enacted similar pension reforms to those in SB 1. Emmanuel, who is facing several lawsuits from unions and retirees, will likely lose much leverage in the litigation due to the decision. Like at the state-level, the ruling will likely send city administrators into a frenzy in an attempt to fix the city’s major budget crisis. Chicago Sun-Times journalist, Natasha Korecki notes, that the decision offers political cover for raising taxes. The decision could also set a precedent against the recent trend of “budget-slashing” governors like Rauner and more famously, Wisconsin’s Scott Walker, backing them off of using state pensions as a campaign piñata if their state has similar constitutional protections. However, in the same manner, it could also add both pause and leverage in negotiations between government and public employees’ unions going forward, using the ruling and the resulting budgetary malaise as concrete evidence to justify stingier concessions.

Sources:

Chicago Tribune – Rick Pearson and Kim Geiger

Chicago Sun-Times – Natasha Korecki/AP

Reason – Scott Shackford

Join the conversation!